Dry heat or not, the 113 degree temps expected in Coachella, CA are enough for this South Floridian to prefer our tropical humidity. Salinas, on the other hand, has a beautiful outlook for this week in the high 60s and 70s.

On the East Coast, Adel, GA’s heat continues in the low 90s and rain in the latter half of the week. This weather is winding down South Georgia a little early over the next 10 days. The Carolinas have begun harvesting, avoiding a supply gap.

Blue Book has teamed with ProduceIQ BB #:368175 to bring the ProduceIQ Index to its readers. The index provides a produce industry price benchmark using 40 top commodities to provide data for decision making.

ProduceIQ Index: Not reporting due to insufficient cherry data

Week #25, ending June 24th

Cherries in the Northwest are mourning the loss of their fallen brethren. Due to a late snow in April, which devastated the bloom in some regions, cherries have insufficient volume for the spot market.

Most cherries are going to committed programs without the need for shippers to add any new customers. Estimates are in the 13 to 15 million box range, which is a greater than 25% reduction from last year’s crop. This is the smallest crop since 2013, despite an increase in producing acres.

Cherry prices are literally off the chart. Since the USDA is unable to report open market cherry prices, stating “Offerings insufficient to quote,” the ProduceIQ Index became distorted by the lack of data available. We’ll learn and adapt our calculation methodology to account for these extreme situations. During this time of year, cherries have the highest index weight, primarily since cherries have the highest price per pound.

Though nothing from shipping point, the USDA is including a limited number of cherries at terminal markets. These indicate destination prices now exceed $100 per case this past week. Harvest began around June 10th and should continue for 90 days.

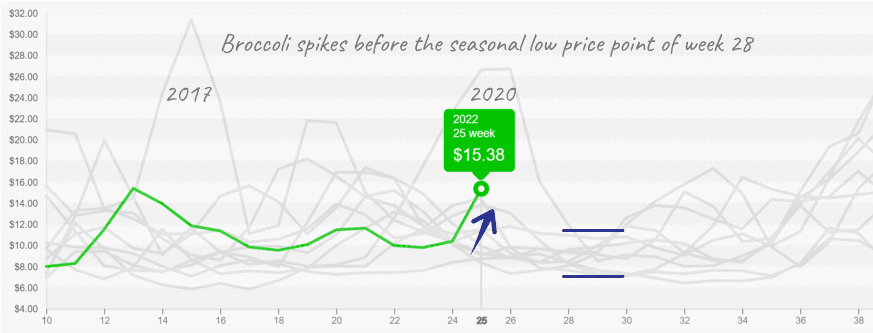

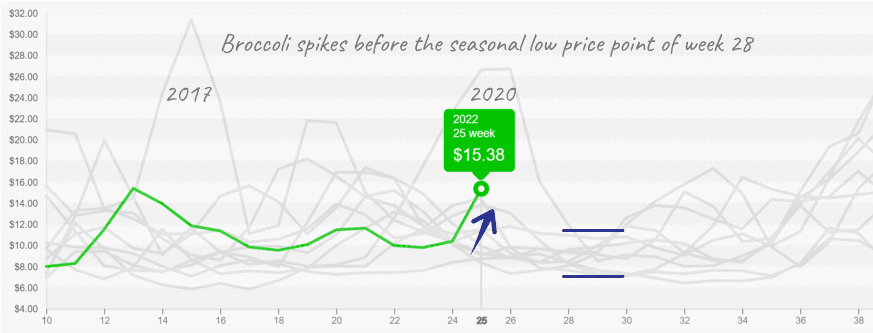

Amongst the lettuce, leaf and wet vegetable categories, Broccoli was the price winner. Broccoli prices rose +45 percent to $15, which is still a far cry from the $27 price in 2020. Western veg prices rose across the board from the extreme temps.

Heat is causing a variety of yield and quality problems as Markon Cooperative outlined in recent article here.

Broccoli prices jump higher off the floor due to supply challenges.

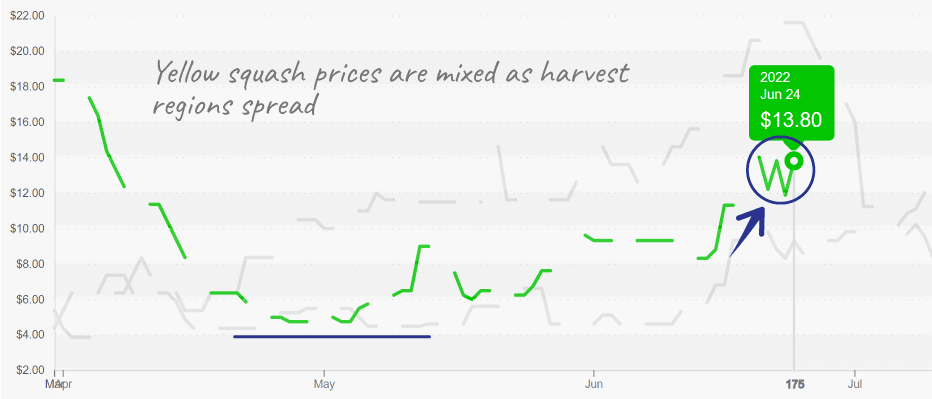

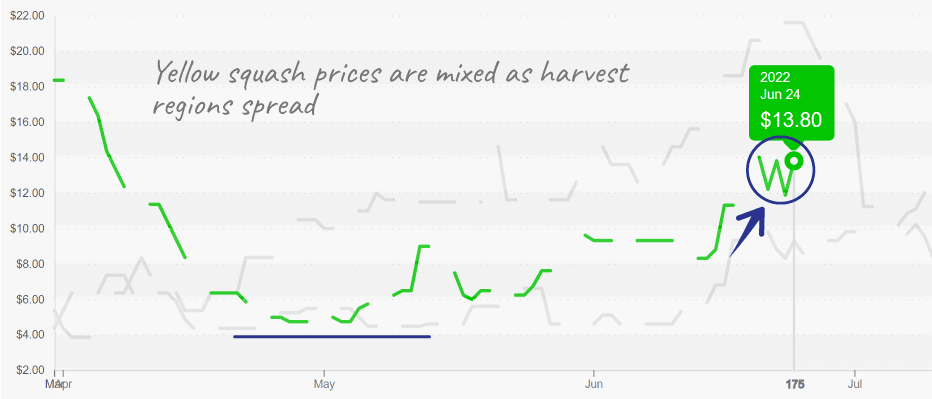

The entire dry veg category is higher this week. Squash and corn led the field. However, cucumbers, bell pepper, and beans were not far behind. Summer has arrived as Georgia is winding down and new growing regions have begun picking. The Carolinas and Tennessee have started. New Jersey is still a few weeks away.

Medium yellow squash prices are finally off the floor; market is active.

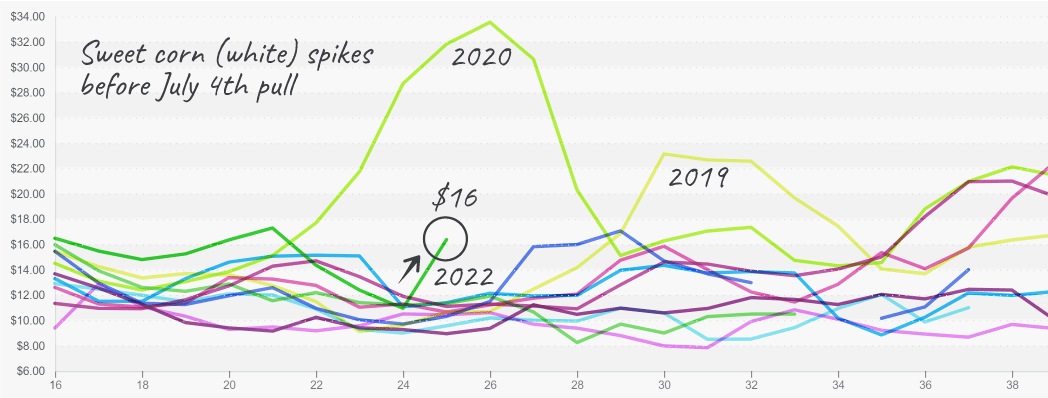

Demand for the upcoming July 4th weekend should cause active markets this week.

Sweet corn prices increase throughout the week and passed $17 Friday.

Please visit Stores to learn more about our qualified group of suppliers, or our online marketplace, here and enjoy free access to our market tools which created the graphs above.

ProduceIQ Index

The ProduceIQ Index is the fresh produce industry’s only shipping point price index. It represents the industry-wide price per pound at the location of packing for domestic produce, and at the port of U.S. entry for imported produce.

ProduceIQ uses 40 top commodities to represent the industry. The Index weights each commodity dynamically, by season, as a function of the weekly 5-year rolling average Sales. Sales are calculated using the USDA’s Agricultural Marketing Service for movement and price data. The Index serves as a fair benchmark for industry price performance.