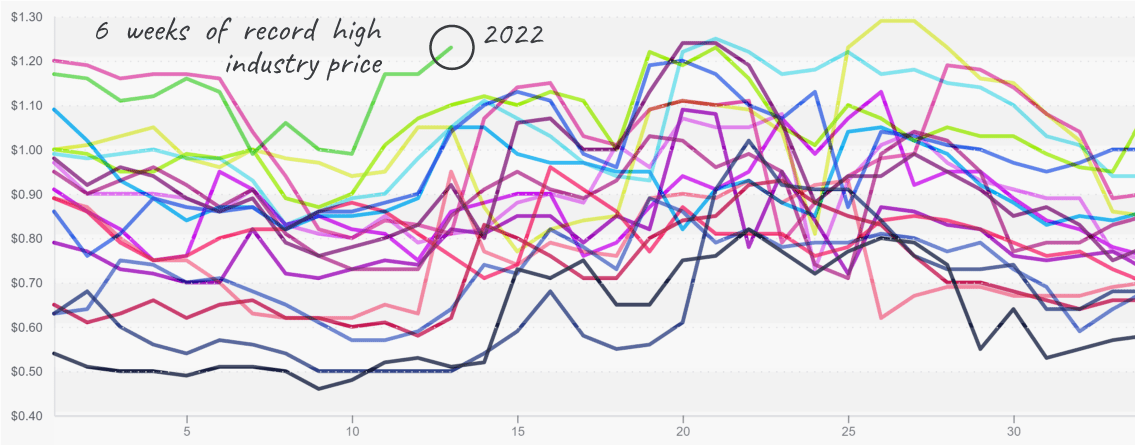

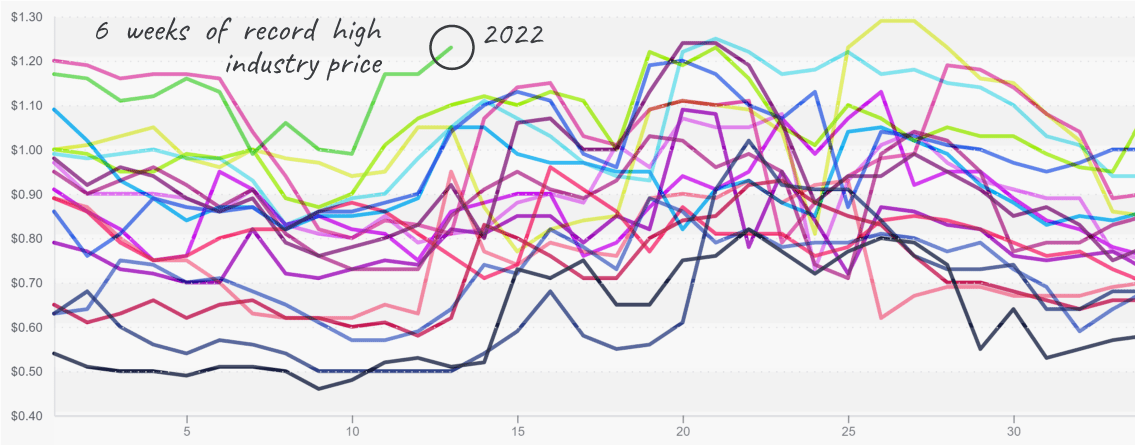

Inflation is not just impacting consumers. FOB shipping point prices have been at a record high for six straight weeks.

At $1.23/pound, the ProduceIQ Index for the overall industry is now 12 percent higher than last year’s record-breaking prices.

Complaints that growers aren’t being paid more may be true for specific commodities. Yet, measured as a whole, the index reveals that b2b inflation is in line with what consumers are paying at retail. Of course, being paid “more” at shipping point may not be enough to compensate for increased growing costs.

ProduceIQ Index reflects record inflation of shipping point prices.

ProduceIQ Index: $1.23 /pound, +5.3 percent over prior week

Week #13, ending April 1st

Blue Book has teamed with ProduceIQ BB #:368175 to bring the ProduceIQ Index to its readers. The index provides a produce industry price benchmark using 40 top commodities to provide data for decision making.

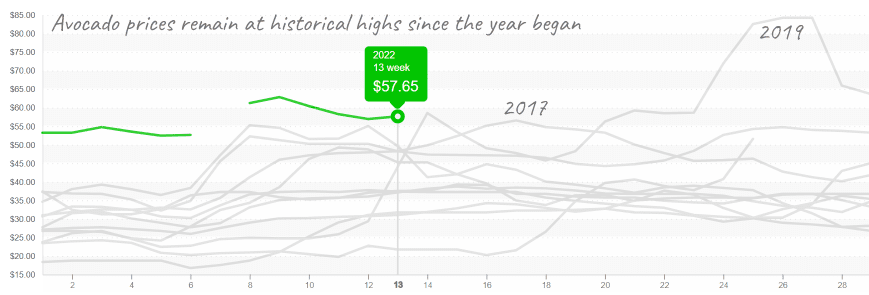

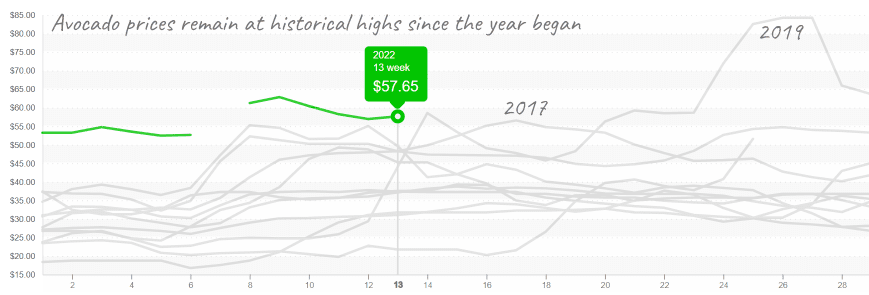

This year April means much more than the first full month of spring. For the first time, the U.S. will allow the importation of avocados grown in Jalisco, Mexico. Jalisco is adjacent to the North and West of Michoacán. The U.S. has only been importing avocados from Mexico, and exclusively from Michoacán, since 1997.

Unfortunately for buyers and avocado lovers seeking lower prices, the policy modification will change very little immediately. That’s because it will take time before the individual producers in Jalisco are certified through the USDA and gain access to domestic markets. However, it is anticipated that the region will be able to provide some relief to U.S. prices in the long term.

Today, Jalisco is better known for growing agave for tequila; compared to Michoacán, Jalisco only produces about 10 percent of its avocado volume. Still, access to the insatiable American avocado markets will almost certainly increase Jalisco’s production in the coming years.

Despite this week’s exciting avocado news, buyers’ current domestic situation is pretty bleak. Though better off than early February, prices are still at record highs, $57 for a 48-count, with very little hope for relief.

However, significant savings are available for smaller sizes: $48 for a 60-count. Mexican export volumes are down again this week and are expected to fall further as Michoacán enters its low season.

Avocado, 48ct, continues to break records.

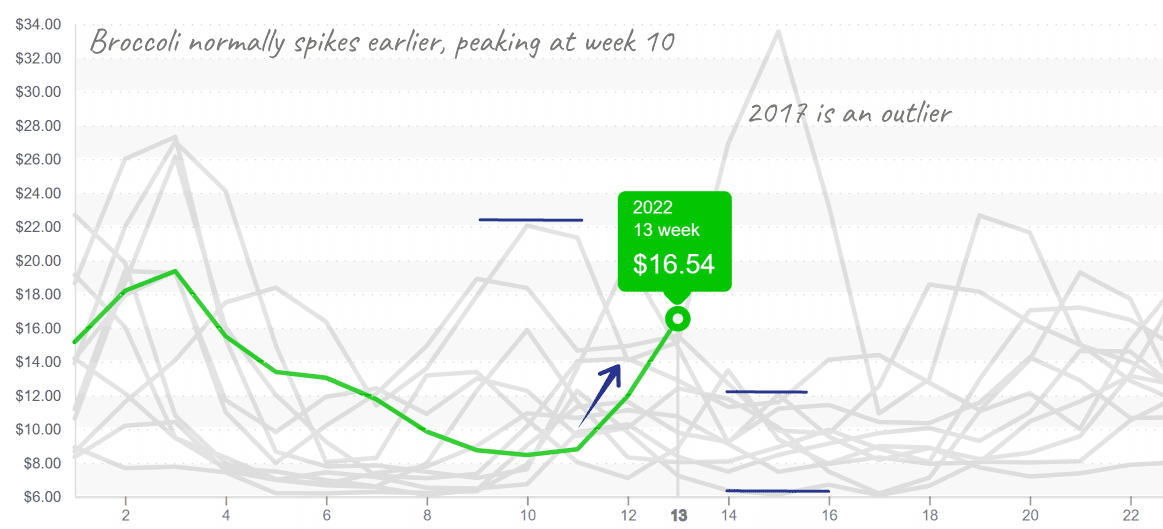

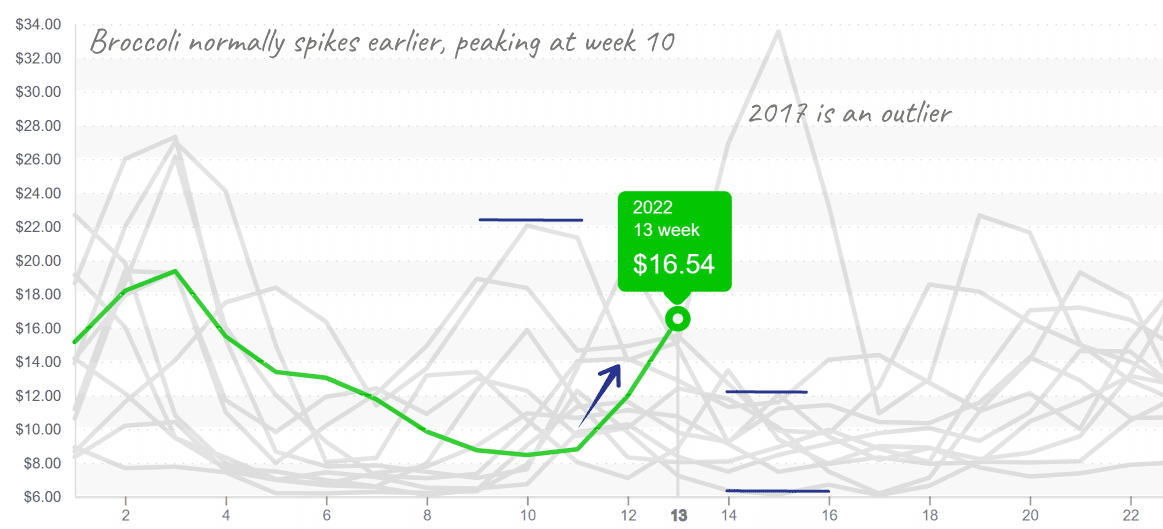

Broccoli prices are soaring like Superman, edging out a ten-year record in response to a gap in domestic production. Throughout the spring and early summer, broccoli supply is highly concentrated. Domestic markets rely on production in Central California and Mexico to meet demand. As a result, prices are highly sensitive to fluctuations in production volume at this time of year.

Arizona’s broccoli production is waning, and California has yet to begin in a significant way. Mexico’s production is starting its annual spring decline and is responsible for about half of the available supply until Salinas Valley is in full swing. Hence, anticipate price instability for the next 2-3 weeks.

Broccoli is having a later season gap, like in year 2017.

Sweet-corn prices typically stabilize in early spring thanks to steady supply from multiple growing regions. However, Mexico is winding down, and production in Florida has a significant gap, causing prices to spike to historic levels for the second year.

The tail end of Mexican production is here; product is being rationed for loyal customers, and color varieties are limited. Corn in Florida was almost non-existent for a week. Harvest began again on Friday, and supplies will build until availability returns to normal during the week of the 11th. Markets will remain elevated until Florida’s spring crop can relieve overextended markets.

After a few strenuous weeks, lettuce markets are finally in recovery. Iceberg and romaine tripled in price over three weeks. Arizona’s supply is still declining, but an increase in California’s production and weaker demand is de-escalating markets.

Keep a close eye on tomato markets. Prices are climbing in response to inclement weather in Florida and Mexico. The cooler temperatures in Florida and warmer Mexican weather are forecasted to affect quality over the next couple of weeks negatively.

Please visit our online marketplace here and enjoy free access to our market tools which created the graphs above.

ProduceIQ Index

The ProduceIQ Index is the fresh produce industry’s only shipping point price index. It represents the industry-wide price per pound at the location of packing for domestic produce, and at the port of U.S. entry for imported produce.

ProduceIQ uses 40 top commodities to represent the industry. The Index weights each commodity dynamically, by season, as a function of the weekly 5-year rolling average Sales. Sales are calculated using the USDA’s Agricultural Marketing Service for movement and price data. The Index serves as a fair benchmark for industry price performance.