Data, scores, and A/R provided sufficient warning and reason for vendors to monitor transactions and outstanding balances with H. Brooks and Company, LLC BB #:100563 New Brighton, MN more closely.

Although much occurred over the next 18 months, there were still glimmers of hope that the company could rebound.

As trade information became more variable, Blue Book contacted company management in late February 2019, sharing that trade information was becoming mixed and challenging the company’s XXX C rating.

Management indicated one of the company’s larger customers had been paying slowly but had recently began to pick up the speed of its payments. Management believed the company’s performance would improve as a result.

Despite this outlook, and after further research, trade information no longer supported the assigned XXX C and in early March 2019, Blue Book reported interim rating numerals (124)(85), meaning, respectively, “rating withdrawn” and “special report available upon request.”

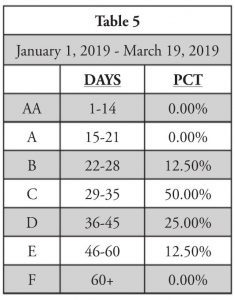

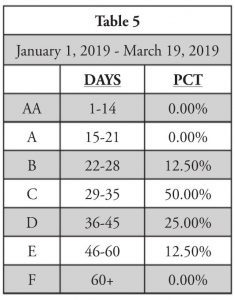

The company’s year-to-date period survey data is seen in Table 5.

Even though delinquency data hadn’t changed significantly on the surface when comparing it to Tables 1 and 2, a few compelling matters were revealed during Blue Book’s investigation: 1) one vendor indicated that the payables clerk advised the company “didn’t have the money to pay the invoice” when calling in, adding “maybe next week”; 2) the other vendor indicated that H. Brooks had started bouncing checks, and 3) A/R data, though more limited than survey data, was showing signs of greater variability and slower pay performance.

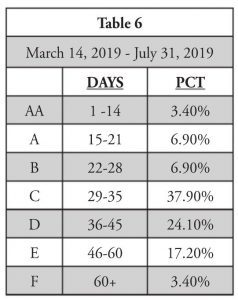

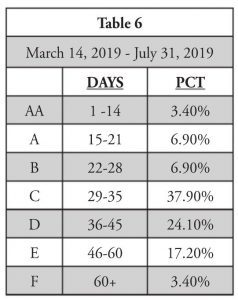

H. Brooks’ Blue Book Score fell from 676 in January 2019 to 661 in March 2019. Blue Book also maintained the (124)(85) interim rating numerals until July 31, 2019, when the rating was revised to (144) XXX148 (149).

The (144) is defined as “specific credit worth estimate not assigned,” while XXX is defined as good trade practices; however, the 148 is regarded as a qualifier and is defined as “have conflicting reports—some report less than XXX experiences.” Lastly, the (149) is defined as “slow pay.” Table 6 reflects the survey data analyzed at the time of the rating change.

The produce industry has seen plenty of companies perform and pay in such a way. Not all sellers see risk the same way, nor do they have the same risk tolerance; yet changes like these are an important indicator that should alert credit teams to adhere to their policies and deploy next steps as needed.

This is an excerpt from the Credit and Finance department of the January/February 2022 issue of Produce Blueprints Magazine. Click here to read the whole issue.