Conventional wisdom would suggest 2021 was littered with business closures in the wake of the onset of the pandemic in 2020.

Of course, we’re still coming out of the pandemic or still living with it on multiple levels and in various ways—but 2021 was not a blockbuster when it comes to closures or bankruptcies. In fact, closures in general were within produce industry norms.

Broad commerce amongst developed nations, despite the pandemic and aside from supply chain shortages, seems to be full steam ahead.

Although the trajectory of the produce industry also appears to be good, Blue Book Services still saw its fair share of closures last year, and we can’t help but wonder if greater challenges and headwinds await.

If so, will businesses be ready?

The challenges of running a business are more numerous and complex than ever before, including rising product, material, labor, and insurance costs; volatile energy prices; industry consolidation and increasing competitiveness; evolving industry regulations and product safety mandates; and rising taxation, to name just a few.

Every year, this Blueprints department discusses a company that closed its doors during the prior year. Our objective is to see if we, as credit extenders, can learn from the company’s decline or help reinforce processes to minimize the impact. For those who were on the short end, this case study will perhaps provide hindsight and lead to more proactive steps when the next customer begins to fail, because it will happen.

The Company

This series of articles looks into a company that began its journey in 1905—a business that went from horse-drawn carriages to utilizing planes, trains, and automobiles, operated through two World Wars, endured nearly 30 presidential elections, and evolved with technology at a rate few produce businesses could match.

Our case study is on H. Brooks and Company, LLC, BB #:100563 in Brighton, MN.

This company, once Blue Book completed its due diligence, was reported as suspending its operations on July 8, 2021. With such a long credit history, it’s not practical to start from the beginning, so we’ll begin on January 11, 2019.

This particular day, with a trade investigation already underway, a service provider called Blue Book to register and share a declining experience with H. Brooks. Pay was reported as slowing, ranging from 35 to 50 days on net 10-day terms.

Most compelling, the service provider indicated that the company was offering too many excuses for slow or lack of payment. At the time of this inquiry, H. Brooks was rated XXX C, assigned on December 18, 2014, and considered to be a good trade practices rating, with payment reportedly received by vendors between 29 and 35 days on average.

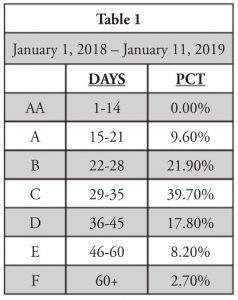

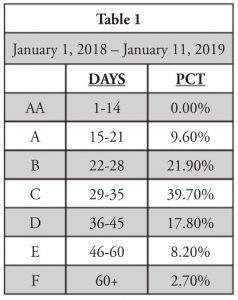

Twelve months prior, as seen in Table 1, 28.7 percent of the pay experiences were reported as beyond the assigned ‘C’ pay description. The central tendency for payment was 29 to 35 days, or C, with standard payment deviations including quicker pay than rated, as well as outlier experiences that could suggest problem files, etc.

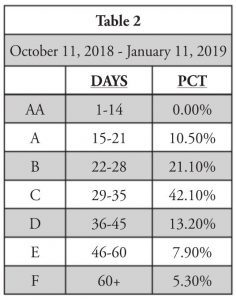

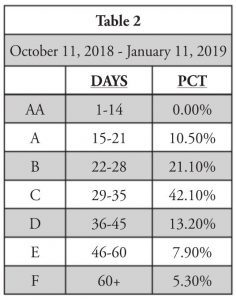

For comparative purposes, Table 2 shows three months prior and leading up to the January 11, 2019 experience.

As seen in Table 2, on a strong and deep data sample, 26.4 percent of pay was reported beyond the assigned ‘C’ pay description, a small improvement over the last 12 months and still within the limits of its Blue Book rating.

Although the survey data supported H. Brooks’ XXX C rating, its Blue Book score was lower than what an average XXX C-rated company would normally be, at 676 (average = 770). This often suggests data is less consistent and variability may be creeping in.

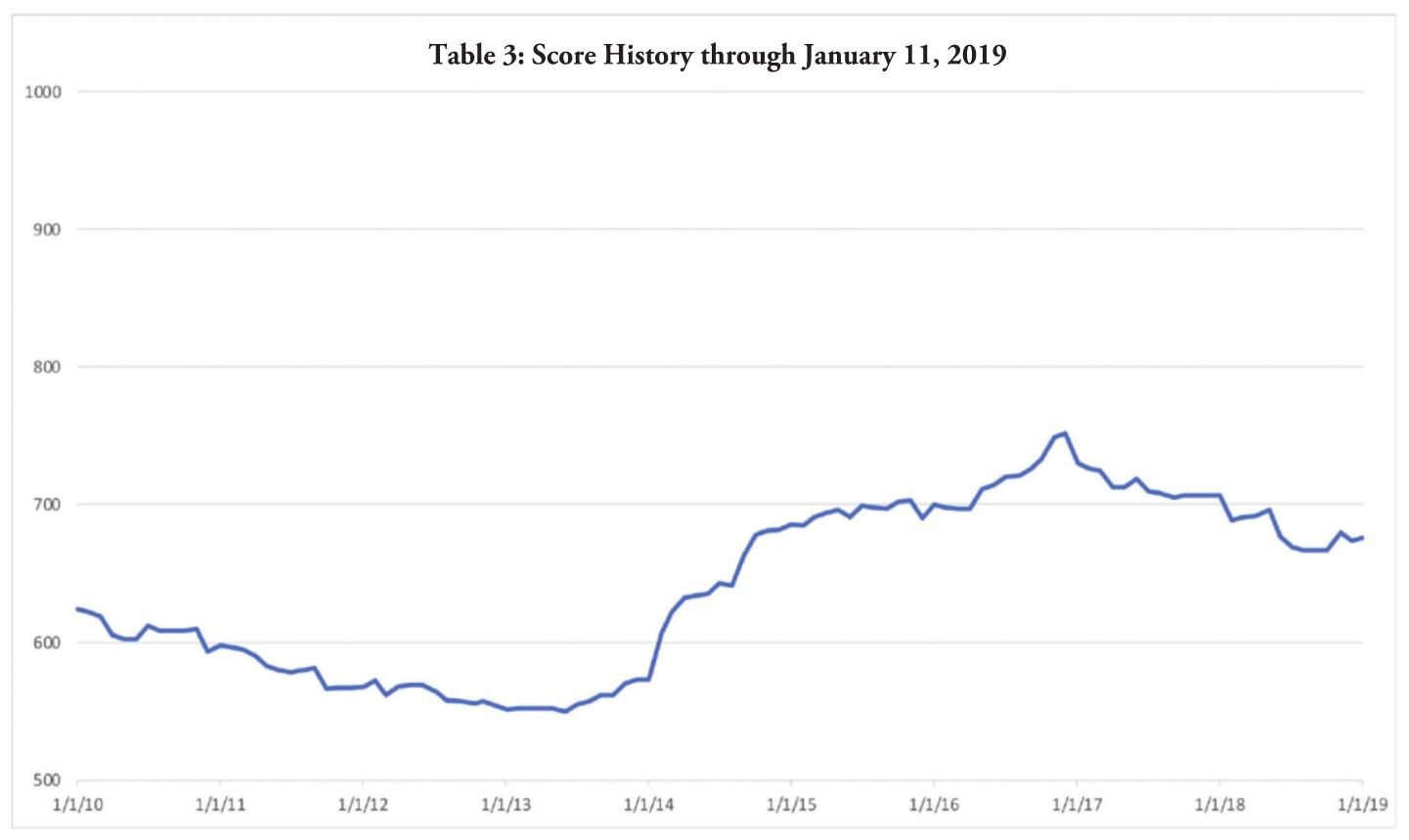

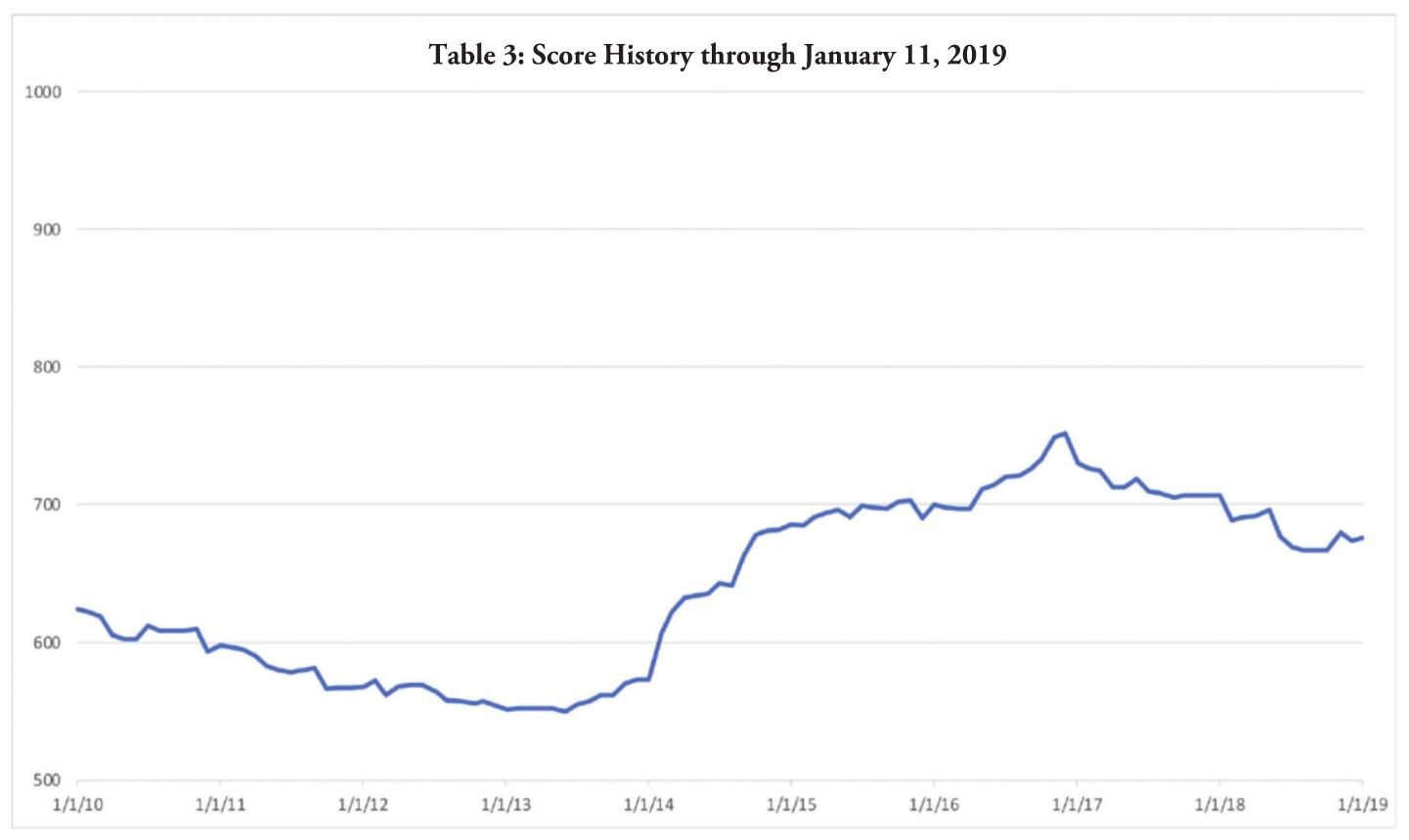

Blue Book scores are defined as the likelihood of delinquency and/or default within a 12-month period and range from 500 (high risk) to 999 (low risk), so 676 is regarded as a moderately high-risk score. For score history context, Table 3 shows the score pattern of the company for the last several years.

As seen, the company’s Blue Book score ranged between 550 and 730 during this period, regarded as high to moderate risk. This suggests past volatility in pay performance, with improvement later in the decade, but still with risk that merited close monitoring.

Though more limited than the referenced survey response, accounts receivable (A/R) contributors shared a greater delinquency (45 plus days) pattern during this period than Tables 1 and 2, and the data is noteworthy: 12 months before the inquiry in January 2019, 36.1 percent of the total amount outstanding was delinquent; at 6 months, delinquent balances were 44.7 percent; and 3 months prior to the inquiry, 48 percent of outstanding invoices were recognized as delinquent.

This is an excerpt from the Credit and Finance department of the January/February 2022 issue of Produce Blueprints Magazine. Click here to read the whole issue.