The following is a letter to the editor from Lance Jungmeyer, President of the Fresh Produce Association of the Americas BB #:144354

Facts Matter. Over the years, we have become accustomed to statements from Southeastern U.S. produce growers about their competition from Mexico. Officials from Florida and Georgia throw around terms like “unfair trade” so much that the public becomes immune to the term, which has real meanings under defined trade law.

The produce industry media goes to great lengths to present all perspectives, and we are better off for it.

However, when facts are misrepresented, or presented without elemental context, the public record must be corrected.

As such, it is important to highlight factual inaccuracies in a recent article published online and included in the larger November/December 2021 Produce Blueprints magazine Tomato Spotlight.

Unfortunately, the reporting in the overall piece seems to incorporate many inflammatory, unsubstantiated talking points that we have seen being raised by the Florida tomato industry as part of the PR campaign against imported tomatoes from Mexico.

While the larger article included in Blueprints does include several dubious statements, it bears drawing attention to the inaccuracies in the portion of that article focusing on tomatoes from Mexico.

The article states, “Unfair trade practices by Mexico have been a hot button issue for the Florida produce industry for years.”

However, there have been no findings of industry-wide unfair trade practice as outlined by the U.S. government. This is the kind of unsupported, inflammatory wording used by the Florida tomato industry, and it’s unfortunate to see it parroted here.

The reporter states that the volume of Mexican produce increased 20.6% last year. However, that is not supported by reports from the USDA Foreign Agricultural Service and U.S. Census Bureau data.

The USDA Foreign FAS data shows that when comparing January through October 2020 and January through October 2021, the percent increase in volume is 6 percent. If you look at the data from 2019-2020, during the start of the pandemic, volume increased .4% for Mexican tomatoes.

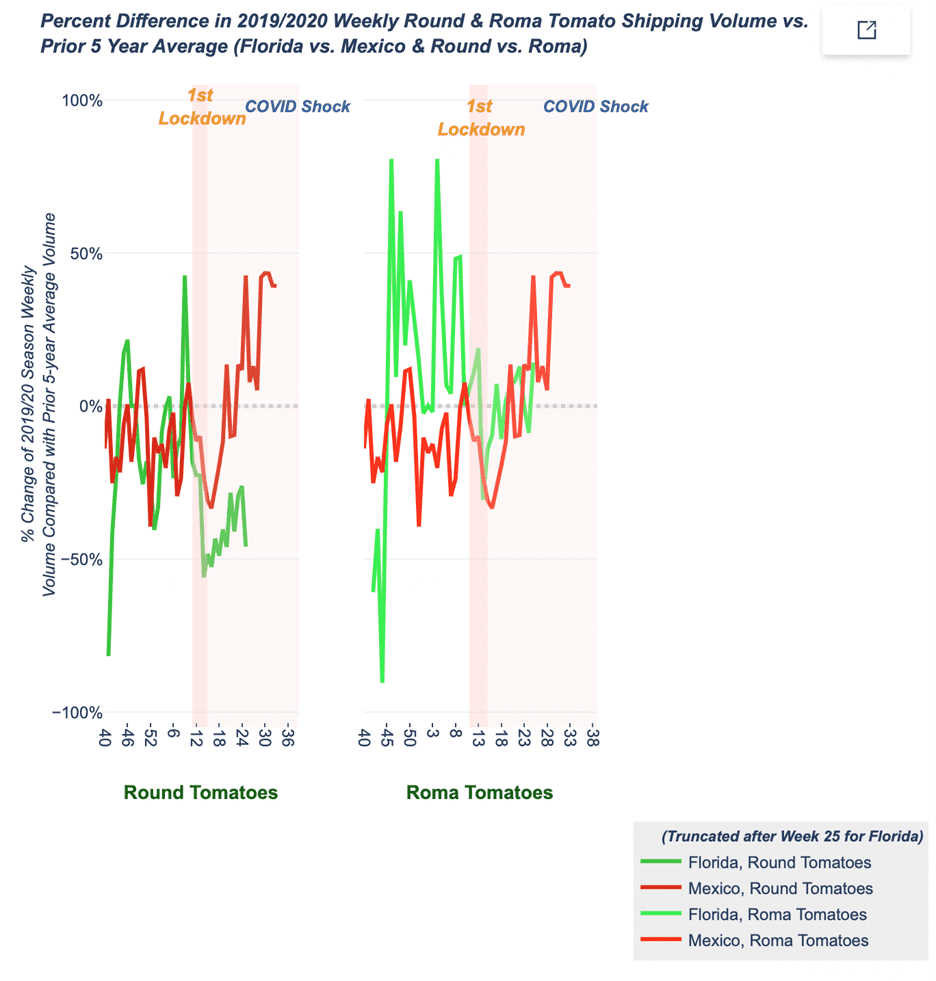

Value increased during that same time by almost 22 percent. With the shutdown of many restaurants and other foodservice operations in the early days of the COVID-19 outbreak, the increase in value is in large part because tomatoes grown in Mexico are more suited to retail customers and were in strong demand, unlike the gas green tomatoes grown in Florida and sold predominantly to foodservice.

For an objective look at how COVID-19 impacted the Florida tomato industry, this StoryMap from the University of Arizona describes how the market behaved. The chart below, based on USDA/AMS data, shows how round tomatoes (such as those grown primarily in Florida) plummeted while roma tomatoes (sourced often from Mexico) took off.

The article also states that “About 80 percent of Mexican tomato imports to the United States are Romas,” which is incorrect. Looking at USDA Market News Data, roma tomatoes represent approximately 49 percent of overall tomato exports from Mexico. Mexico is also a large supplier of vine-ripe, cluster, grape, and cherry tomatoes.

Under the “More Changes” section of the article, the reporter highlights the recent challenges discussed before the U.S. Department of Commerce on the definition of Free On Board (FOB) as it applies to the Tomato Suspension Agreement.

While the reporter is not responsible for the erroneous claims by the Florida Tomato Exchange that previous agreements failed, it would be fair to note that the preliminary decision by Commerce supported the FPAA and broad industry position that the FOB price as the Agreement was negotiated does include the industry-standard movement and handling charges to the first point of sale near the border.

To correct a claim made by Michael Shadler that was left to stand in the article, no previous Tomato Suspension Agreement has failed. Each five years, the Agreement is renegotiated per the requirements of U.S. trade law, and each five years since 1996, a new Agreement has been signed by the Department of Commerce and the growers in Mexico.

The article references a claim that “The Mexican government provides substantial support for protected agriculture, with incentives covering up to 50 percent of the investment cost.”

While an existing program geared toward small producers provides limited funding to some small infrastructure projects; the investments from Mexico have been negligible and well below allowable Amber Box Spending as defined by the World Trade Organization.

The spending in Mexico is especially negligible when compared to the subsidy spending in the United States. A report from the University of Arizona provides reliable information on this topic.

It is unfortunate that in the research for the section on Mexican tomatoes, the sources cited include two Florida representatives and only one tomato broker.

In a study by the University of Arizona, tomatoes from Mexico are directly responsible for creating over 30,000 U.S. jobs. For such a large and diverse U.S. industry that imports and distributes tomatoes from Mexico, it is unfortunate that the plethora of industry experts were largely ignored for the perspectives of Florida companies to talk about tomatoes from Mexico.

These days, there is a lot to say about trade. And everyone is saying their part. Especially from the Southeast.

However, it goes without saying that one should consider the source, when one considers what is said.

As we continue the dialogue about the relative value and “fairness” of international trade, words matter and facts matter.