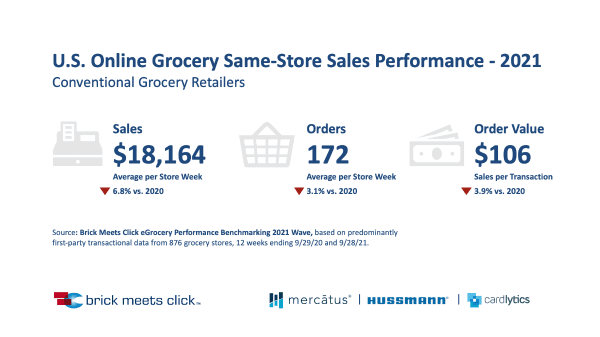

Barrington, Ill. – January 18, 2022 – Conventional grocers reported a 6.8% drop in online grocery sales on a same-store basis during the 12 weeks ending September 28, 2021, versus the prior year, according to the Brick Meets Click eGrocery Performance Benchmarking 2021 Wave.

A 3.1% decrease in orders combined with a 3.9% decline in the average order value contributed to the drop in sales on a year-over-year basis.

The recently completed research, sponsored by Mercatus, Hussmann Corporation, and Cardlytics, resumed the benchmarking initiative that Brick Meets Click started in 2016 but paused in 2020 due to the pandemic. Based on online transactional data linked to non-personal identified households across nearly 950 stores from 45 U.S. banners, the study is the largest independently conducted online grocery benchmarking initiative completed to date.

“We know from our monthly eGrocery shopping survey that Mass is driving the online grocery sales gains in the broader U.S. market,” said David Bishop, partner at Brick Meets Click, “so benchmarking is incredibly valuable because it enables Grocery retailers to compare their performance versus their peers to identify improvement opportunities.”

The first of the initiative’s three reports releases this week and focuses on Topline Performance Findings, including key causal factors that can impact performance, such as how long a service has operated, what services are offered by each store, and where the store operates.

Among the findings:

Age of online operations did not significantly impact overall performance. The 7% of locations that had operated their online grocery services for less than a year did not report significantly lower sales compared to stores with longer running operations, likely due to COVID-related circumstances. Before COVID, Brick Meets Click documented a strong and positive correlation between sales and the age of the service.

Offering customers multiple ways to receive orders did impact performance results. Weekly online grocery sales for stores that offered both pickup and delivery were 44% higher than stores offering only delivery and 55% higher than stores offering only pickup.

In aggregate, delivery accounted for over 60% of all online orders, but when stores allowed customers to receive orders via either delivery or pickup, delivery’s share dropped to just over 50%. Only 49% of stores in the sample offered customers the choice between the two methods.

Stores in medium-sized markets generated higher weekly sales than stores in more-populated trade areas. This is a significant flip compared to the 2019 benchmarks, and most likely due to the growth in the availability of competing online services in the larger markets.

“As an equipment solution provider, our goal is to help the retail store and fulfillment center to excel at executing the strategy,” said Dan Sullentrup, vice president of e-commerce at Hussmann Corporation. “The challenge is there’s no one, simple solution as there are many variables that need to be considered and vetted with the retailer’s overall strategy.”

The complete results of the Brick Meets Click eGrocery Performance Benchmarking 2021 Wave will be released in a series of three reports.

Part One, Top-line Performance Findings, releases this week, followed by a public webinar, featuring Bishop and Sullentrup on Thursday, March 3 at 1 pm CT.

Part Two, Key Customer Metrics, releases in mid-February and focuses on key customer metrics, ranging from acquisition and churn rates to buying patterns by customer cohort and more, supported by additional perspective from Cardlytics.

Part Three, Top-Quartile Analysis, releases in mid-March and focuses on revealing factors and issues that can show grocers how they can further improve performance with practical guidance from Mercatus.

For information about access to the research and the reports, go to brickmeetsclick.com.

About this research

The Brick Meets Click eGrocery Performance Benchmarking is an annual initiative based on ePOS data provided by participating retailers. It began in 2016 with 17 grocery store banners and has grown to 45 banners for 2021. The study examines the critical business questions related to improving strategy and execution when operating a first-party ecommerce shopping service.

About Brick Meets Click

Brick Meets Click is an analytics and strategic insight firm that connects today’s grocery business with tomorrow’s needs. Our clear thinking and practical solutions help clients make their strategies and customer offers more compelling and relevant in the changing U.S. grocery market. We bring deep industry expertise, knowledge of what’s coming next, and fact-based analysis to the challenge of finding new routes to success.

About Mercatus

Mercatus helps leading grocers get back in charge of their eCommerce experience, empowering them to deliver exceptional retailer-branded, end-to-end online shopping, from store to door. Together with our partners, we enable clients to create authentic digital shopping experiences with solutions to drive shopper engagement, grow share of wallet and profitability, and quickly adapt to changes in consumer behavior.

About Hussmann

Hussmann Corporation, a wholly owned subsidiary of Panasonic, promises to continuously provide the most customer-focused solutions in the food retailing industry. For more than 115 years we have been the innovation and technology leader delivering the broadest and most comprehensive solutions to our market including the cutting-edge e-commerce offering, eGrocery. We collaborate with customers to deliver better businesses, better partners and a better world.

About Cardlytics

Cardlytics (NASDAQ: CDLX) is a digital advertising platform. We partner with banks to run their rewards programs that promote customer loyalty and deepen relationships. In turn, we have a secure view into where and when consumers are spending their money. Using these insights, Cardlytics helps marketers identify, reach, and influence likely buyers at scale, as well as measure the true sales impact of marketing campaigns.

Media Inquiries

David Bishop, Partner, Brick Meets Click

847-722-2732, david.bishop@brickmeetsclick.com

www.brickmeetsclick.com