Ahh… The first week of the year. In a perfect world, Christmas lights have been packed neatly into plastic tubs, your Roomba vacuum has managed to sweep up the last few bits of New Year’s confetti, and fresh produce prices are enjoying a good holiday snooze.

But alas, those Christmas lights will probably stay up until February, and fresh produce prices are anything but predictable.

The adage that “even Vegas is boring to a produce farmer” holds true as the new year begins. Even the shelf-stable ‘hardware’ items such as carrots, potatoes and onions, are encountering price spikes and significant supply challenges. As a result, growers of storage crops are declining the opportunity for new customers while hoping to cover existing commitments through the spring.

Too few available trucks are fueling headaches across the fresh produce industry. Delivery delays are widespread, and record-breaking truck rates are being paid. Hopefully, the supply chain will find its sanity again when drivers return from the holidays to their regular lanes.

ProduceIQ Index: $1.17/pound, +7.3 percent over prior week

Week #1, ending January 7th

Blue Book has teamed with ProduceIQ BB #:368175 to bring the ProduceIQ Index to its readers. The index provides a produce industry price benchmark using 40 top commodities to provide data for decision making.

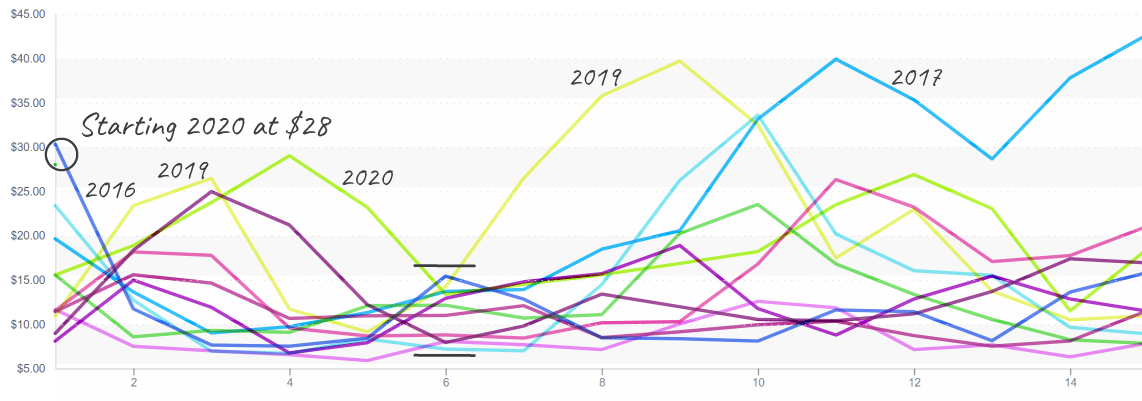

The beginning of Chile’s export season for high-value commodities, such as peaches and nectarines, is soaring on higher ocean freight costs. Due to the +30 percent increase in freight fare, the prices of these imported fruits are also elevated, according to a recent article published by Blue Book and written by Marco Campos.

USDA data backs up Campos’ claims. Week #1 prices for peaches, nectarines, and grapes are on the higher end of historical precedent. For example, peach and nectarine markets are at their second-highest starting price in the last ten years. The historical pattern is for prices to decline steadily through the 16-week season.

Imported Peaches start 2022 at over $23 with high inbound freight costs.

Like many commodities that did not go according to prediction this week, bell pepper markets are making an unexpected upward leap. Green bell peppers bounced off their $6 floor and are now a respectable $12. A Mexican cold front is stunting green bell supply, and some green pepper is being left on the plant to turn red.

Colored bells, however, are following the inverse trend. For instance, 11-pound red, orange and yellow peppers are being sold for $6 to $8, half the price of two weeks ago. On the bright side, overall bell-pepper quality is good and still a promotable item.

Cauliflower prices are still climbing. Unfortunately, in the California desert, cold weather is slowing cauliflower growth. Overall quality is unaffected by the cooler weather; however, markets will remain stretched for at least another week.

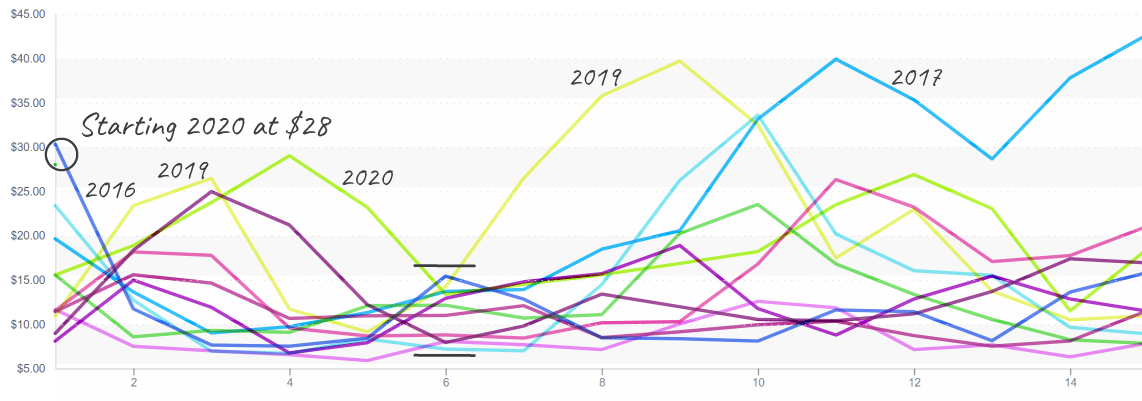

The current year is fighting historical norms for Cauliflower prices, which typically decline through January and mid-February.

Less than ideal California weather is throwing a wrench at more than one fresh produce commodity this week. Rain in Oxnard is wounding celery and strawberry yields.

Celery markets are reportedly short supply but remain on the lower end of historical price precedent. Value-added celery, sticks and diced, are especially lean.

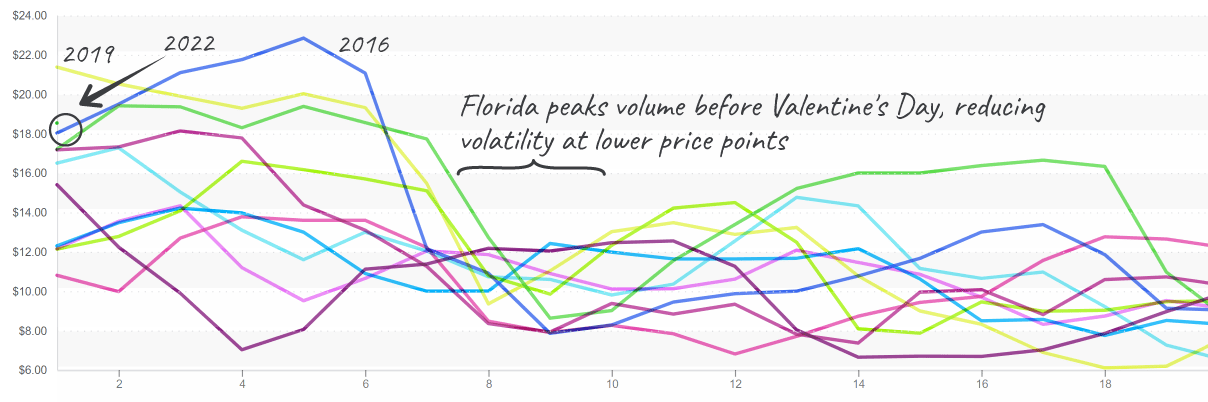

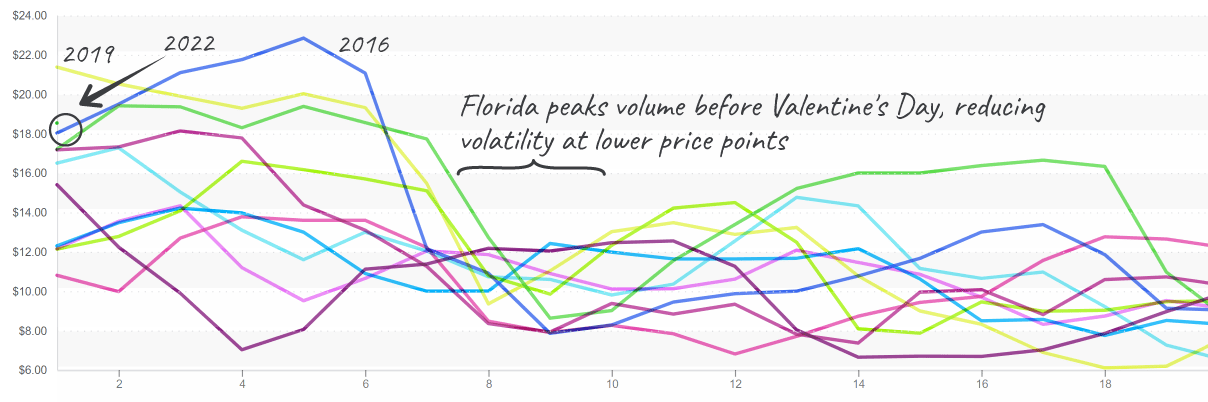

Rain in Oxnard and Santa Maria is elevating already expensive strawberry prices. At over $18, strawberries are at the third-highest price in ten years. Overall supply is mixed with Florida and Mexico trying to ramp up production.

Markets should stabilize within the next week as post-holiday production picks up and more quality product is available. Strawberries remain a destination item through Valentine’s Day.

Strawberry prices begin a volatile time period at over $18/case.

Please visit our online marketplace here and enjoy free access to our market tools which created the graphs above.

ProduceIQ Index

The ProduceIQ Index is the fresh produce industry’s only shipping point price index. It represents the industry-wide price per pound at the location of packing for domestic produce, and at the port of U.S. entry for imported produce.

ProduceIQ uses 40 top commodities to represent the industry. The Index weights each commodity dynamically, by season, as a function of the weekly 5-year rolling average Sales. Sales are calculated using the USDA’s Agricultural Marketing Service for movement and price data. The Index serves as a fair benchmark for industry price performance.