While New York City bathed in balmy 60-degree temps, Southwestern growing regions shivered in the low 30’s. If you thought that combination is a guarantee for high market prices, you’d be wrong.

Despite mild winter temps, demand for fresh produce in The Big Apple is relatively modest.

NYC’s restaurant scene has yet to return to pre-covid levels. Reduced tourism, heavy Covid restrictions and generally high retail prices are putting a damper on consumer demand.

Many produce folks from the lesser-restricted states of Texas and Florida weren’t quite psychologically ready for the mask and vaccine-card requirements during the recent New York Produce Show.

Though optimism is always high in the produce industry, many corporations, not ready to lift travel restrictions, were missing from the big event. Nevertheless, the energy in New York is always infectious.

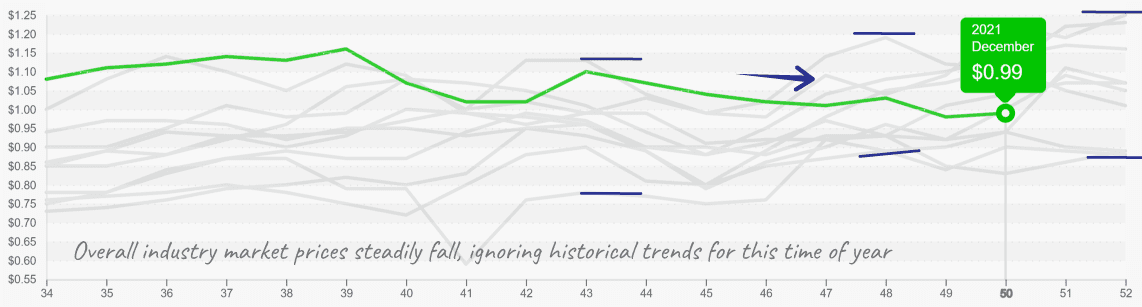

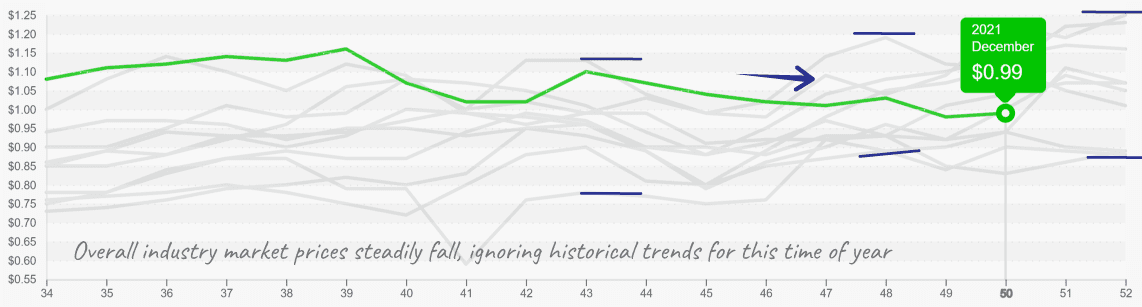

Leverage over FOB prices is shifting to buyers as they recover from an overly optimistic Thanksgiving pull. Buyers are taking a conservative strategy regarding inventory during the upcoming holidays. Due to high freight rates and looming covid-uncertainty, shipping point prices remain in peril.

Industry prices are flat when demand (and prices) should have begun increasing.

ProduceIQ Index: $0.99/pound, +1.0 percent over prior week

Week #50, ending December 17th

Blue Book has teamed with ProduceIQ BB #:368175 to bring the ProduceIQ Index to its readers. The index provides a produce industry price benchmark using 40 top commodities to provide data for decision making.

Somebody, please pass lettuce a coat! Frosty temperatures are triggering packing and harvest delays in the desert. Weak demand and steady supply keep current prices stable; however, more cold weather is expected over the next seven days. Ice-related injury is a possibility, but current product is reportedly suffering minimal damage.

After reaching $50/case only six weeks ago, Iceberg lettuce is now at fire-sale prices.

While lending lettuce a hand, grab hold of your wallet. For the second week in a row, Hass Avocado prices are at a ten-year high. U.S. markets are nearly entirely reliant on Mexico to meet demand this time of year. Although current supply is technically providing enough coverage, the avocado market is strengthening fast and prices with it. Markets are forecasted to increase throughout the end of the year.

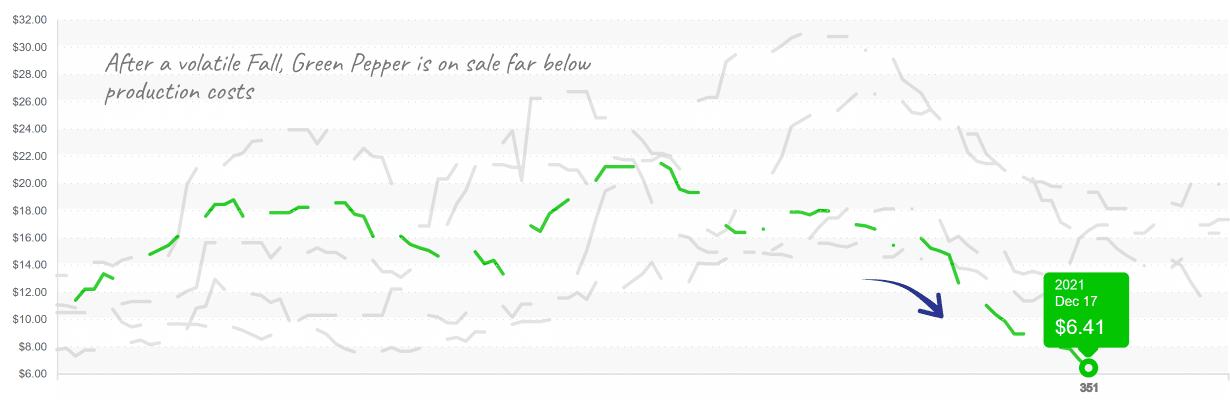

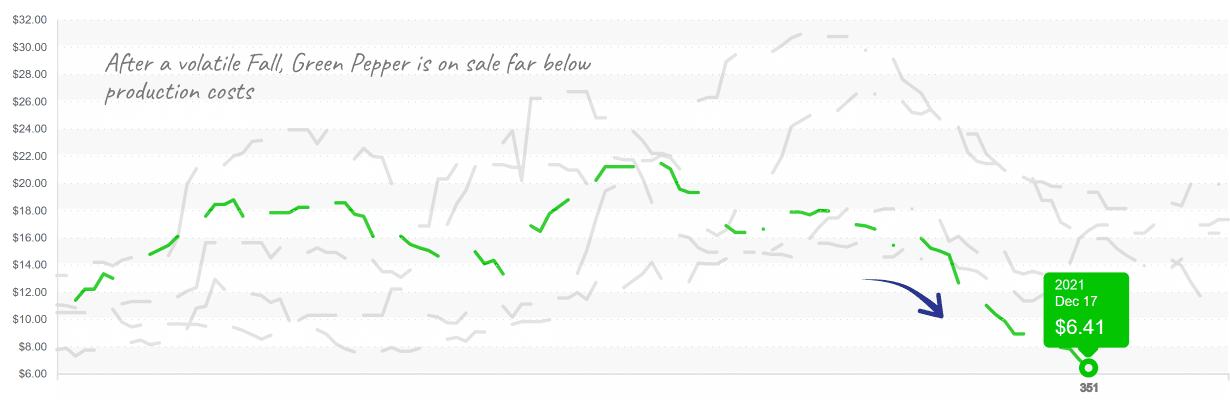

On the opposite end of the spectrum, green bell peppers are near their price floor. A solid Mexican harvest and steady supply out of Florida are sending green bell markets into a tailspin. When inventory risks aging, pepper may be found offline for deals even below the paltry $6 reported by the USDA. These prices hover at the most basic level of variable costs: picking, hauling, packing and the cardboard box. So, share some holiday cheer by promoting green bells, and let’s move some volume.

Green bell pepper prices reach the floor as Mexico and Florida increase production.

Not all bell peppers need a price pick-me-up, as red and yellow bells are both in short supply. As a result, prices for both commodities are holding firm. Field-grown varieties of colored peppers are starting over the next few weeks, which should ease elevated markets.

The average strawberry price is down -13 percent over the previous week. Strawberry volumes are improving with product available out of California, Texas and Florida in a light way. Still, markets are somewhat fragmented due to inconsistent product availability. Expect prices to fall further as Mexico and Florida escalate production.

Blueberry prices lurch slightly upwards in response to waning Peruvian production. Even with Mexican and Chilean growers working hard to fill the gap, blueberry markets may strengthen for a couple of weeks before prices deescalate again. The silver lining within that somewhat blue news, prices are still on the lower end of historical precedent.

Please visit our online marketplace here and enjoy free access to our market tools which created the graphs above.

ProduceIQ Index

The ProduceIQ Index is the fresh produce industry’s only shipping point price index. It represents the industry-wide price per pound at the location of packing for domestic produce, and at the port of U.S. entry for imported produce.

ProduceIQ uses 40 top commodities to represent the industry. The Index weights each commodity dynamically, by season, as a function of the weekly 5-year rolling average Sales. Sales are calculated using the USDA’s Agricultural Marketing Service for movement and price data. The Index serves as a fair benchmark for industry price performance.