(Week #43, ending October 30th)

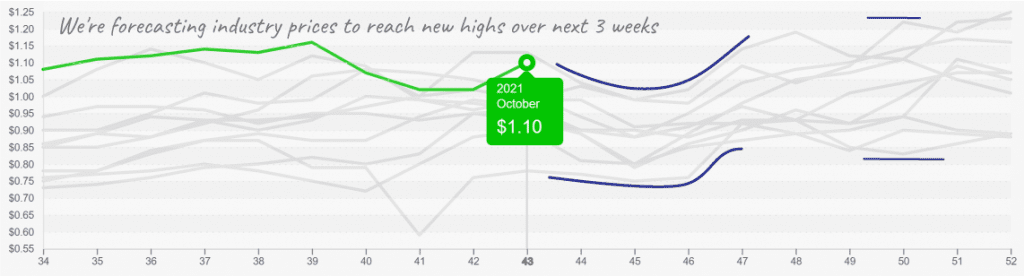

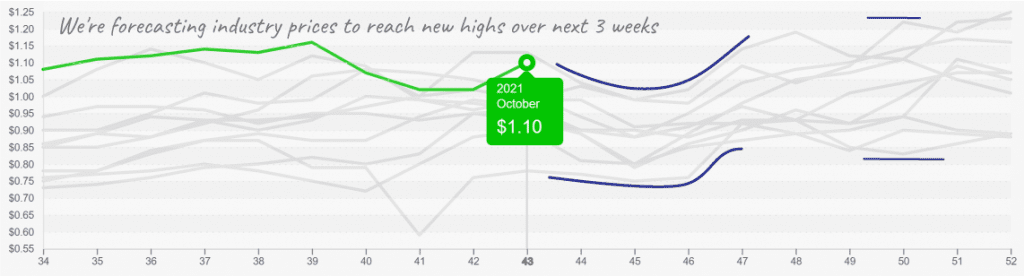

ProduceIQ Index: $1.10/pound, +7.8 percent over prior week

Mysterious Halloween storm brings much needed rain to the Northwest. Then, a nor’easter slammed Maine and Massachusetts in the same week. Although Halloween is notorious for gobs of candy, produce markets do see small upticks in demand for seasonal items like pumpkins, apples and, thanks to an aggressive ad campaign by Dole…pineapples?!

Bombogenesis, a word recently added to our vocabulary after a freak storm pummeled the Northwest early last week. A weather system rapidly developed into a cyclone off the coast of Northern California bringing eerie hurricane like winds and much needed rain to growing regions across the Pacific Northwest.

The storm brought enough rain to raise one reservoir, Orville Dam, +33 feet. Full disclosure, most reservoirs only saw increases by a few feet, but because of the unique shape of Orville Dam, the storm’s impact is dramatic.

Produce market prices are typically falling this time of year and don’t accelerate until week 46 for the Thanksgiving pull. However, this year, supply is particularly strained, waiting for Mexico to begin in higher volume during November. Markets are poised to reach record highs next week and this may persist for a few weeks until Mexican supply improves.

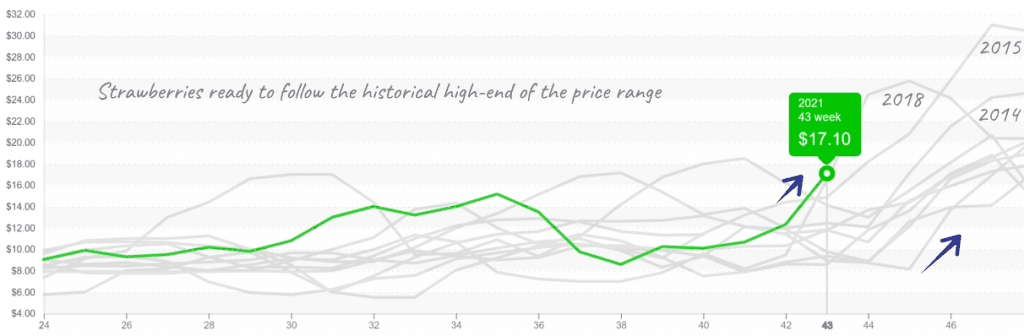

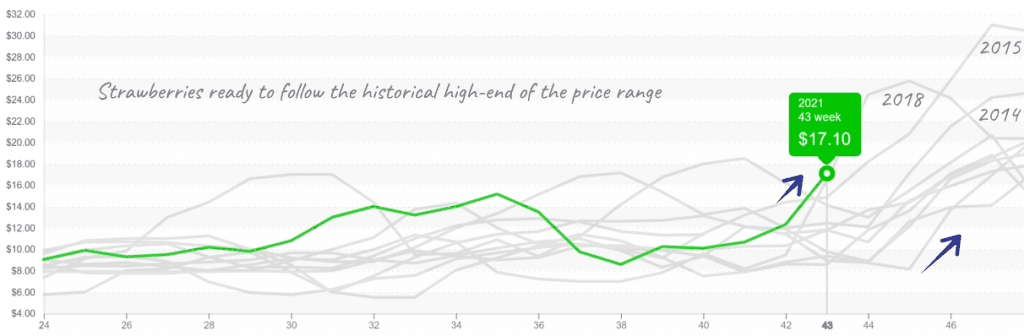

Despite the beneficial rain, the torrential weather did leave an innocent bystander in its wake. What was left of the Salinas/Watsonville strawberry crop suffered loss due to the intense wind and rain.

Blue Book has teamed with ProduceIQ BB #:368175 to bring the ProduceIQ Index to its readers. The index provides a produce industry price benchmark using 40 top commodities to provide data for decision making.

Between the storm, limited Mexican supply and the delayed start to Southern California’s season, strawberry markets are tight. Prices are up +48 percent over the previous week. Expect to see continued price volatility as markets impatiently wait for the arrival of So-Cal supply.

Apple prices typically peak around week #40 and steadily decrease as domestic supply lessens the pull of demand on markets. Apples aren’t the most expensive they’ve ever been, but they certainly aren’t cheap. Due to poor yields and waning harvest in Washington, week #43 prices are at their third highest in the last five years.

Weak demand and plentiful, quality supply drives asparagus prices lower for the third week in a row. Week #43 asparagus prices are at a ten-year low by a healthy margin. Consistent Mexican supply will continue to drive prices lower and set more records along the way.

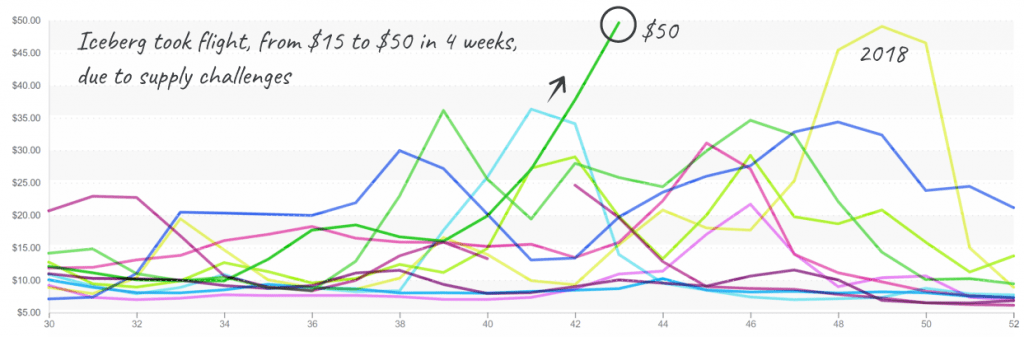

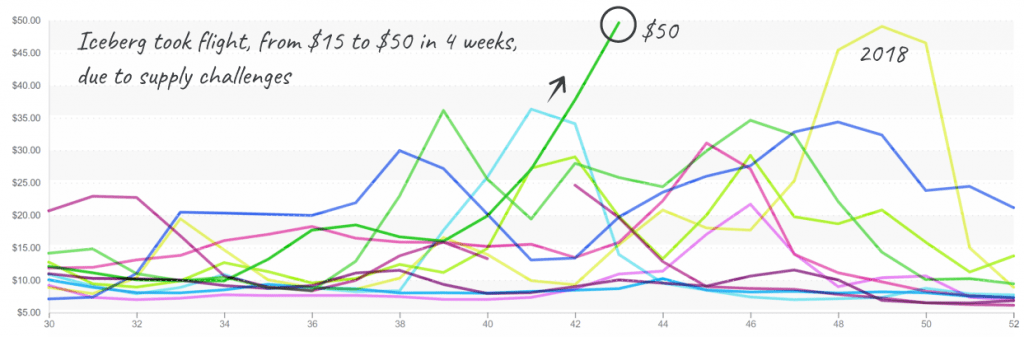

On the opposite end of the price spectrum, Iceberg lettuce nears an all-time high. Do no mistake this for mere weekly record. Iceberg is as close to gold as a fresh produce commodity will ever be.

Prices are up +32 percent over the previous week and are forecasted to continue climbing due to a rain damaged Mexican crop. The only kryptonite that will stop this lettuce hero’s flight is a bumper crop out of Yuma. Summary, rough time to be a salad bar owner, great time to be a lettuce farmer with quality crop.

Please visit our online marketplace here and enjoy free access to our market tools which created the graphs above.

ProduceIQ Index

The ProduceIQ Index is the fresh produce industry’s only shipping point price index. It represents the industry-wide price per pound at the location of packing for domestic produce, and at the port of U.S. entry for imported produce.

ProduceIQ uses 40 top commodities to represent the industry. The Index weights each commodity dynamically, by season, as a function of the weekly 5-year rolling average Sales. Sales are calculated using the USDA’s Agricultural Marketing Service for movement and price data. The Index serves as a fair benchmark for industry price performance.