Week #38, ending September 24th

ProduceIQ Index: $1.13/pound, -0.9 percent over prior week

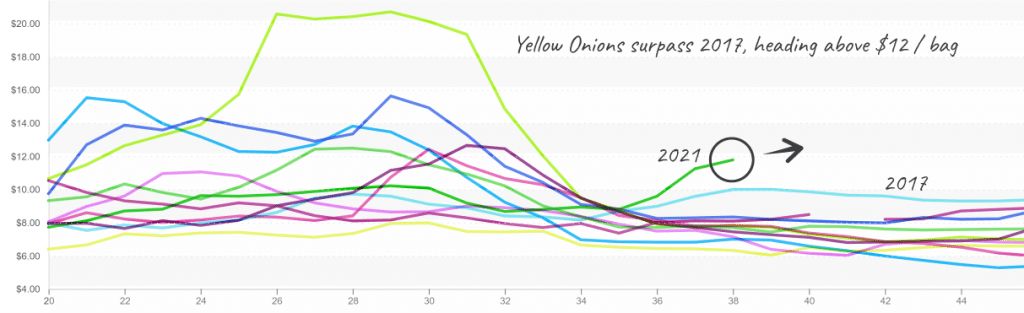

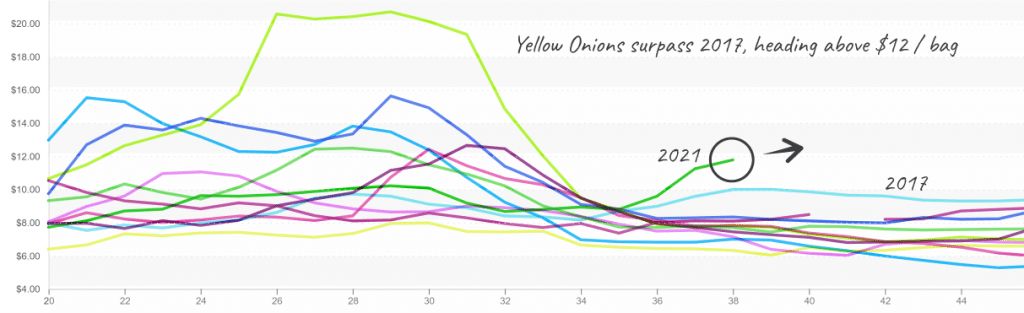

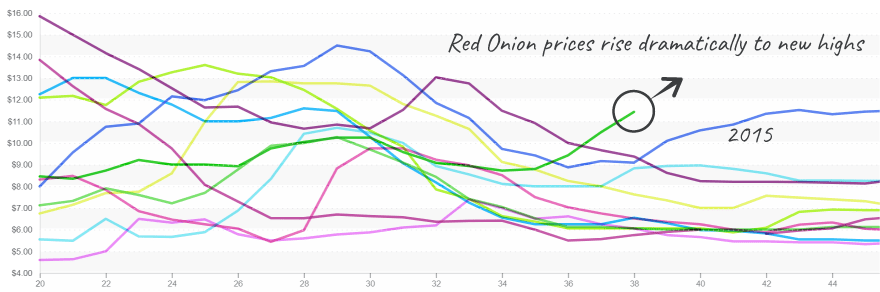

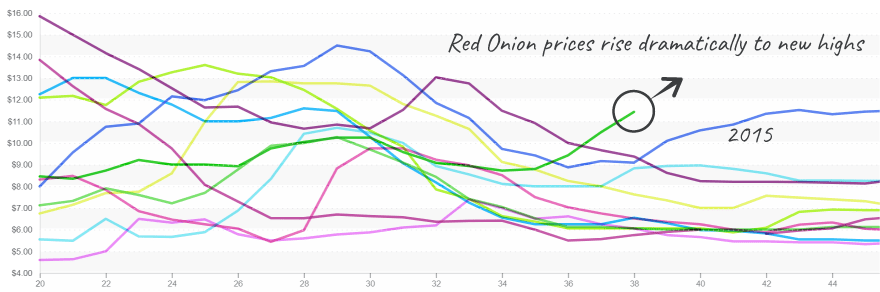

Dry Onions are at a ten-year high for week #38. One of the more predictable commodities in the ProduceIQ index, onions are fighting stereotypes with a zest of volatility.

Strained markets, aggravated by lower yields from a hot summer and a myriad of inflation-related supply chain issues, force growers to taper back current sales to store up enough crop when yields are low. Current season sizes are running small in both yellow and red onions. Expect domestic supply to remain tight throughout the fall/winter season.

Domestic Pear Season is in full swing. Volume out of the Pacific Northwest is increasing and will continue throughout October. Though current season yields are decent, they are not high enough to prevent high prices. As a result, the pear index is trading at $0.82 per pound, only surpassed once in the last ten years by 2020 prices.

Both Western and Eastern tomato supplies are stretched thin. Extreme heat in the West and waning yields in the East are pushing tomato prices upwards, +26 percent over the previous week. Expect some relief in a few weeks when suppliers regain their footing with help from Mexican and Florida growers.

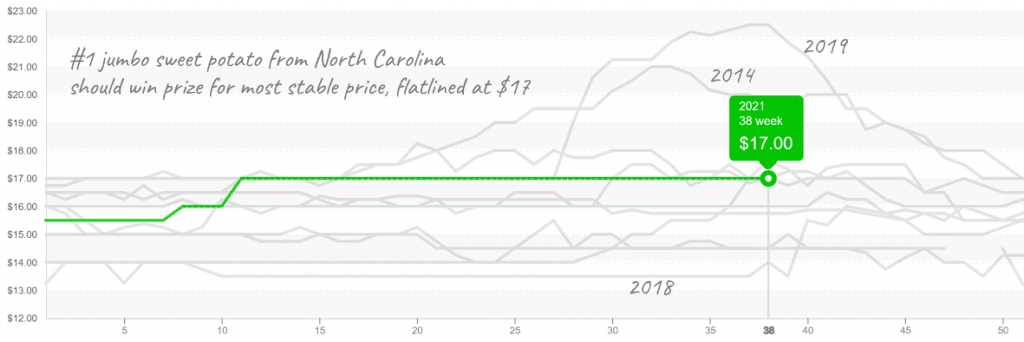

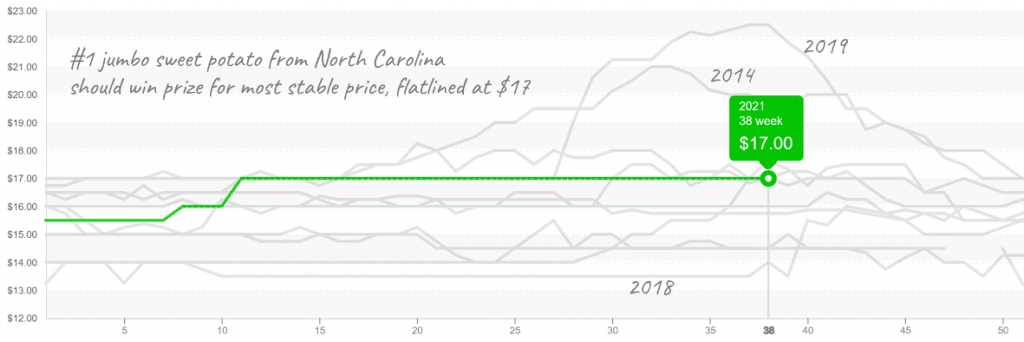

Sweet potato prices typically peak in late summer for the storage crop and decline when growers harvest throughout September and October. New crop won’t be available until November after it has had time to cure. California production is lower than expected. North Carolina’s prices have been stable and should remain sedated until demand picks up as the Thanksgiving season approaches.

By week #38, asparagus prices are usually on the way down. However, logistics challenges for Peruvian crop, too much rain in Mexico, and a seasonal transition are severely reducing the current supply. Asparagus prices exceed $33 per 11 lb with little relief in sight.

Please visit our online marketplace here and enjoy free access to our market tools which created the graphs above.

ProduceIQ Index

The ProduceIQ Index is the fresh produce industry’s only shipping point price index. It represents the industry-wide price per pound at the location of packing for domestic produce, and at the port of U.S. entry for imported produce.

ProduceIQ uses 40 top commodities to represent the industry. The Index weights each commodity dynamically, by season, as a function of the weekly 5-year rolling average Sales. Sales are calculated using the USDA’s Agricultural Marketing Service for movement and price data. The Index serves as a fair benchmark for industry price performance.