After only a moment of record high prices, markets begin descending.

The overall industry’s price decline has two major drivers: supply volume increased in both vegetables in South Georgia and stone fruit from the Northwest.

Georgia’s spring season is fast and furious. Prices in the dry vegetable category fall each year when Georgia hits full harvesting stride.

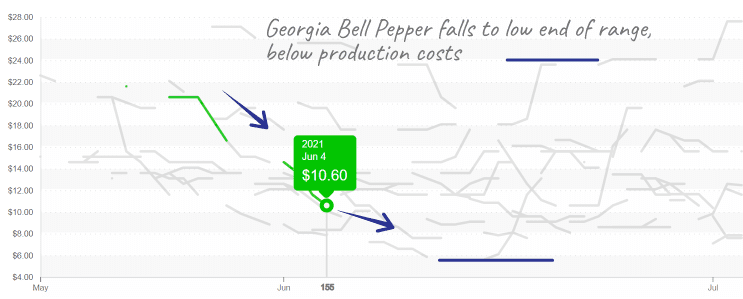

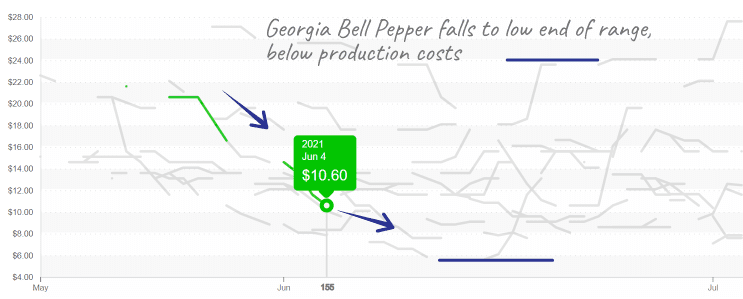

Although harvesting began a little late this season, Georgia has now arrived. The famous red Georgia clay is producing quality pepper and a wide variety of vegetables. Georgia’s XL green bell pepper has fallen from $20 to $10 in two weeks.

Interestingly, California peppers have remained high at $18. Due to the cost of freight and the majority, (58%) of the U.S. population, living East of the Mississippi river, the norm is for FOB prices on the East Coast to exceed that of the West Coast.

Not so today. A gap in the transition from Coachella to the San Joaquin growing regions is keeping prices high. At these prices, this pepper needs to stay local in the West.

Georgia pepper prices will fluctuate, though tend to decline in early June and rise in early July when volume slows.

ProduceIQ Index: $1.14 /pound, -9.5 percent over prior week

Week #22 ending June 4th

Blue Book has teamed with ProduceIQ BB #:368175 to bring the ProduceIQ Index to its readers. The index provides a produce industry price benchmark using 40 top commodities to provide data for decision making.

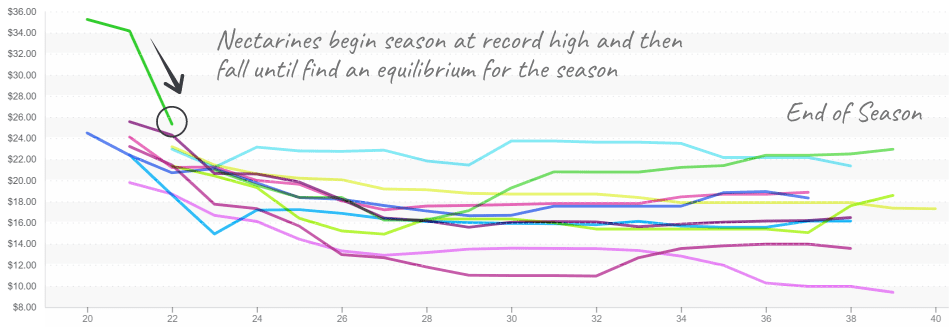

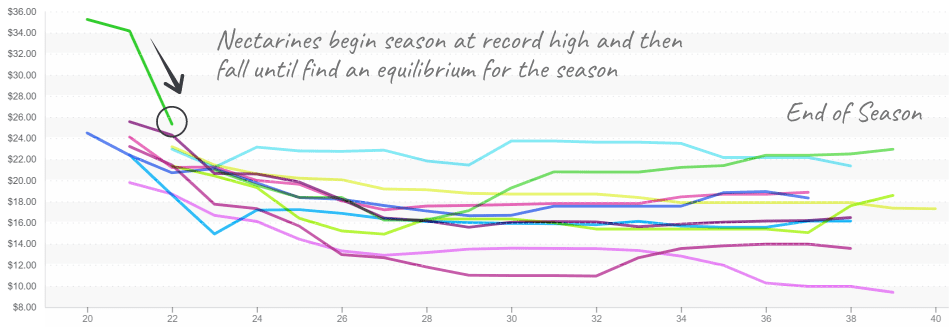

Stone fruit season starts with high prices and then descends after the volume of supply increases.

Each year varies, but this general pattern holds. Retailers eager to have the first cherries (or peaches or nectarines) are willing to pay more for the early fruit. Prices fall as higher volume comes online and needs to move quickly.

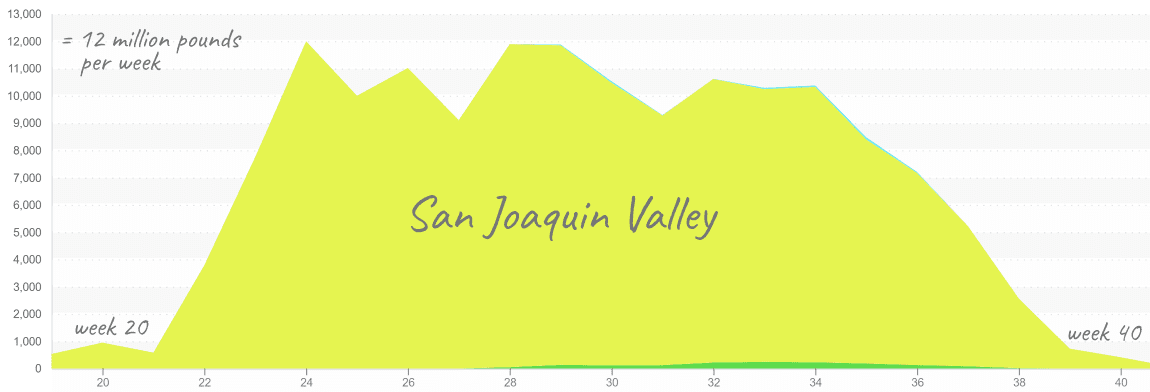

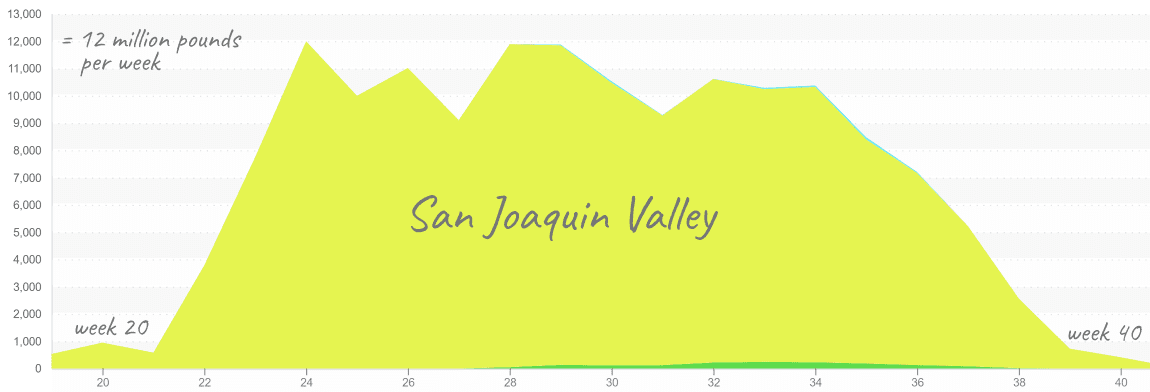

Nectarines started the season with a bang at $35, and now they are $25. The historical norm falls until volume begins to plateau around week 24. San Joaquin volume remains high until week 35 and steadily tails off for another month.

Prices start high; of course, these are on low volume until the San Joaquin season ramps up.

San Joaquin valley supplies the vast majority of nectarines, peaking at around 12 million pounds per week (USDA movement data for 2019).

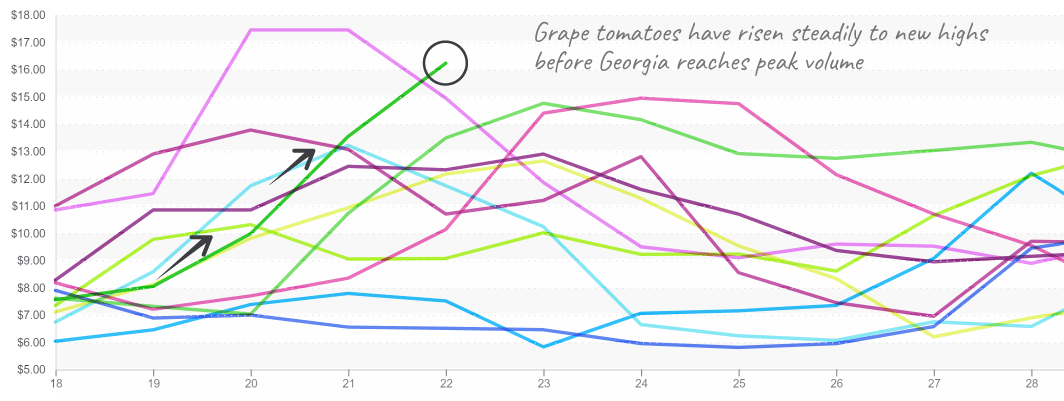

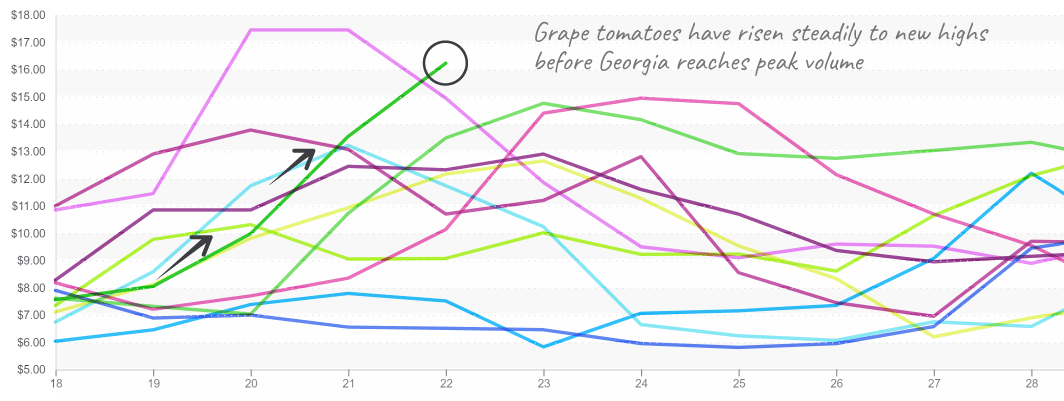

Tomatoes are an exception. As a category, tomatoes jumped 25 percent last week. Roma volumes are reducing, causing a 40 percent price increase to over $16. Georgia hasn’t begun meaningful harvest of cherry or grape tomatoes. Anticipate prices to fall as June progresses.

Grape tomatoes exceed $16 per case (12 1-pint clamshells) during a transitional gap.

Please visit our online marketplace here and enjoy free access to our market tools which created the graphs above.

The ProduceIQ Index is the fresh produce industry’s only shipping point price index. It represents the industry-wide price per pound at the location of packing for domestic produce, and at the port of U.S. entry for imported produce.

ProduceIQ uses 40 top commodities to represent the industry. The Index weights each commodity dynamically, by season, as a function of the weekly 5-year rolling average Sales. Sales are calculated using the USDA’s Agricultural Marketing Service for movement and price data. The Index serves as a fair benchmark for industry price performance.