Memorial Day pull sends prices skyward.

The industry is looking at the highest week #21 prices of all time. Shaped by demand in retail-bound produce categories, markets are on pace to normalize record-breaking weeks.

“Inflationary factors abound,” said Costco CFO Richard Galanti during an earnings call last week. He pointed to higher wages, freight costs, increased consumer demand, and supply chain chaos with “various shortages of everything.”

Fresh produce is right at home within his list.

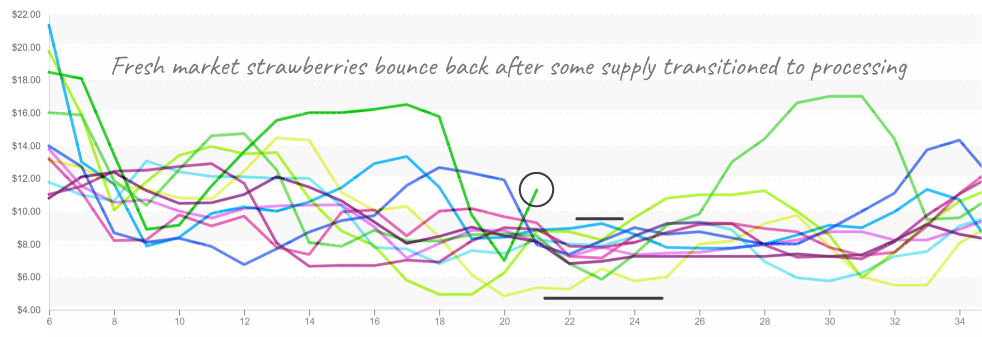

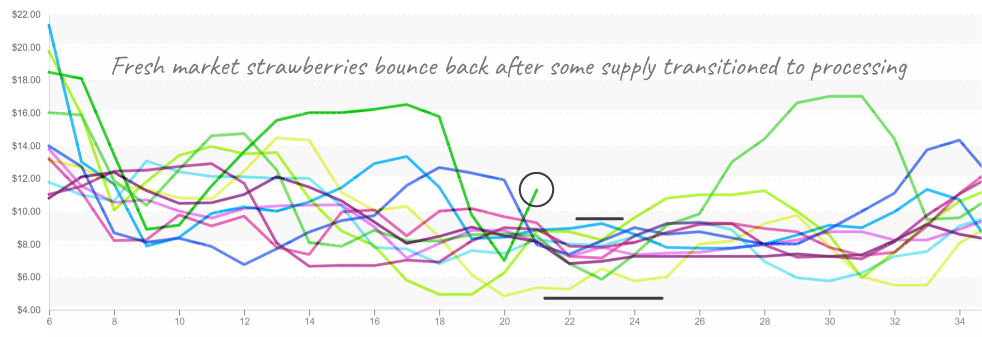

After testing price floors, strawberries bounced back and are struggling to keep up with impressive demand. This week strawberry prices topped out at a record $2.11 per pound, far surpassing 2019, the previous record-holder at only $1.36 per pound.

Strawberry prices bound higher than the typical low-price range.

ProduceIQ Index: $1.26 /pound, +5.0 percent over prior week

Week #21 ending May 28th

Blue Book has teamed with ProduceIQ BB #:368175 to bring the ProduceIQ Index to its readers. The index provides a produce industry price benchmark using 40 top commodities to provide data for decision making.

Despite the increased holiday demand, mixed berries’ (blackberries, blueberries, and raspberries) overall prices are trending downwards. Growing regions are ramping up volume and providing relief to tight markets.

Hard-pressed grape markets are granted some reprieve by Mexican growers. After last week’s historic rise, prices are down -11 percent. Coachella Valley will begin harvest on green grapes next week and should continue to provide some respite for buyers in a bind.

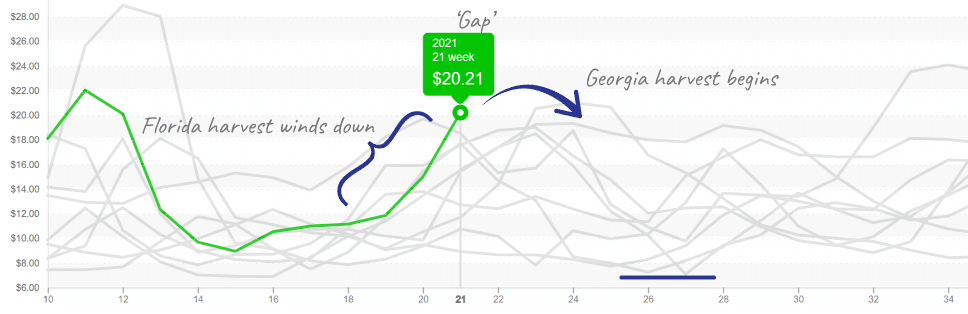

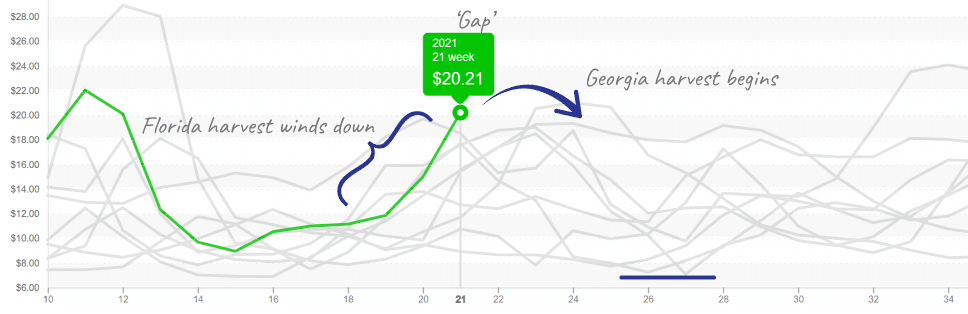

Grape tomato prices are up due to an ongoing gap in supply. Expect limited availability until the second week of June when Georgia and South Carolina begin harvesting.

Grape Tomatoes enter a recognizable gap in supply.

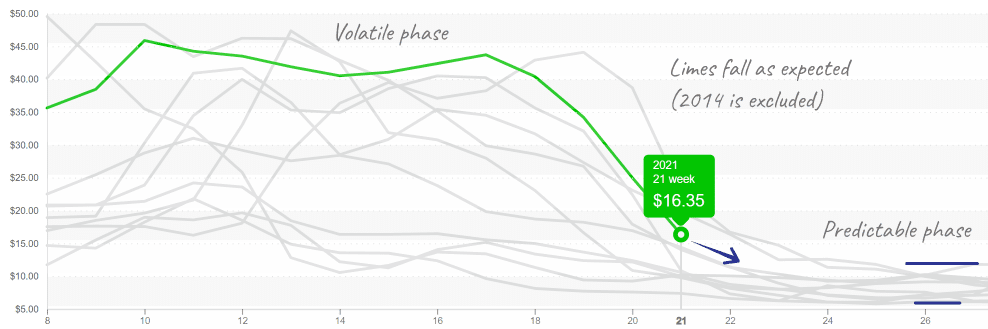

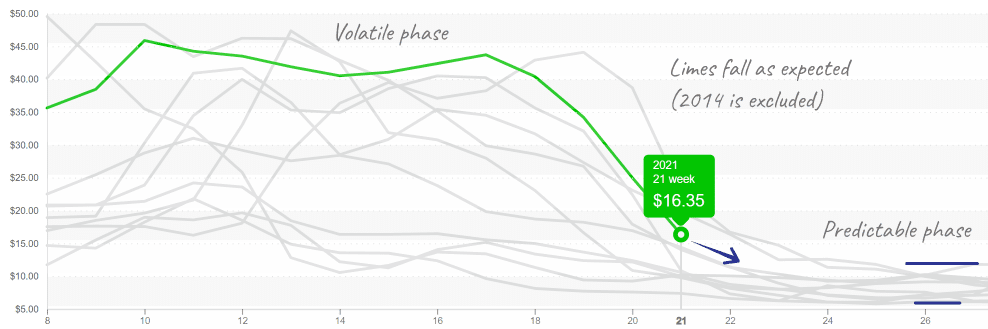

Limes took a nose-dive. Supply is gradually improving, particularly on smaller-sized limes. Buyers looking for larger sizes are still struggling to find a steady supply.

Lime buyers rest easy as prices leave the volatility and fall back in line with predictable supply.

As it goes in the world of citrus, when limes go down, lemons come up. Demand for lemons is outpacing a light supply. Buyers should expect increased prices as the Central Valley season settles. The mid-June import season will provide some relief to prices.

Memorial Day pull sparked watermelon prices this past week. Prices rose +31 percent on good supply. Despite dramatic increases, watermelon prices were coming off the floor and are still within the realm of historical norms.

ProduceIQ invites all readers to pause and reflect on those who have sacrificed their lives serving in the United States military. We are grateful and honored to be an American company supported and protected by the men and women of the United States Armed Forces.

Please visit our online marketplace here and enjoy free access to our market tools which created the graphs above.

The ProduceIQ Index is the fresh produce industry’s only shipping point price index. It represents the industry-wide price per pound at the location of packing for domestic produce, and at the port of U.S. entry for imported produce.

ProduceIQ uses 40 top commodities to represent the industry. The Index weights each commodity dynamically, by season, as a function of the weekly 5-year rolling average Sales. Sales are calculated using the USDA’s Agricultural Marketing Service for movement and price data. The Index serves as a fair benchmark for industry price performance.