May 26, 2021 — With Memorial Day right around the corner, Category Partners decided to take a look back at last year and scratch below the surface of what happened during the Memorial Day run up and see what it might mean for the future.

The results were surprising!

Were 2020 Memorial Day lift variances from baselines the result of restrictions, limited size BBQs, or well stocked fridges and freezers from the previous several weeks of “panic buying?”

It is possible and perhaps even likely, but impossible to know for sure.

What is more helpful is looking at the retail sales data to-date and examining which scenario is more likely. 1) A return to 2018/2019 sales patterns or 2) a continuation of the 2020 Memorial Day slump?

As one might reasonably expect, the 2021 retail movement of produce for April and May to-date appears to more closely pattern the 2018 and 2019 performances.

EXAMPLE – ONIONS

In 2020 onion sales were up +61.9 million units (+32%) vs. 2019. This year onions are down -50.4 million units (-20%) versus 2020.

That said, units for the 6 weeks comparing 2021 to 2019 are relatively similar with onions generating +11.5 million (+5.9%). This pattern appears relatively consistent with other major produce categories including avocados and strawberries.

WILD CARDS

Supply chain hiccups (ref. tight availability of pallets) and logistical “bubbles” (ref. Colonial pipeline hack) could be on-going factors and have a directional impact on the retail channel.

With that in mind, it appears the inertia of consumer buying patterns are returning to pre-2020 patterns (at least for the moment).

As a result, all things being equal, Category Partners believes the 2020 Memorial Day “slump” will return in 2021 to the more traditional Memorial Day “bump”.

PERISHABLES BAROMETER

Bakery: Cookies are up +21% in (April-May) units 2021 vs. 2019 compared with a -17% drop in 2020.

Dairy: Butter (Eggs, Milk and Doughs follow a similar trajectory) is up +5.8% in (April-May) units 2021 vs. 2019 compared with a +52% spike in 2020.

Deli: Salads are up +5.4% in (April-May) units 2021 vs. 2019 compared with a -26% drop in 2020.

Meat: Beef, (Chicken and Bacon follow a similar trajectory) is up +4.4% in (April-May) units 2021 vs. 2019 compared with a +33% spike in 2020.

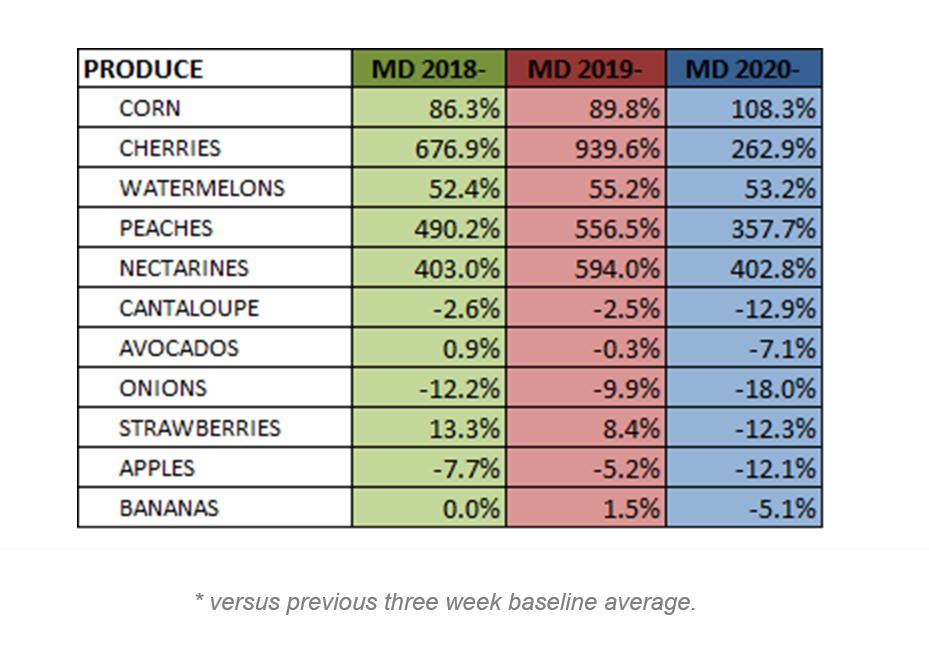

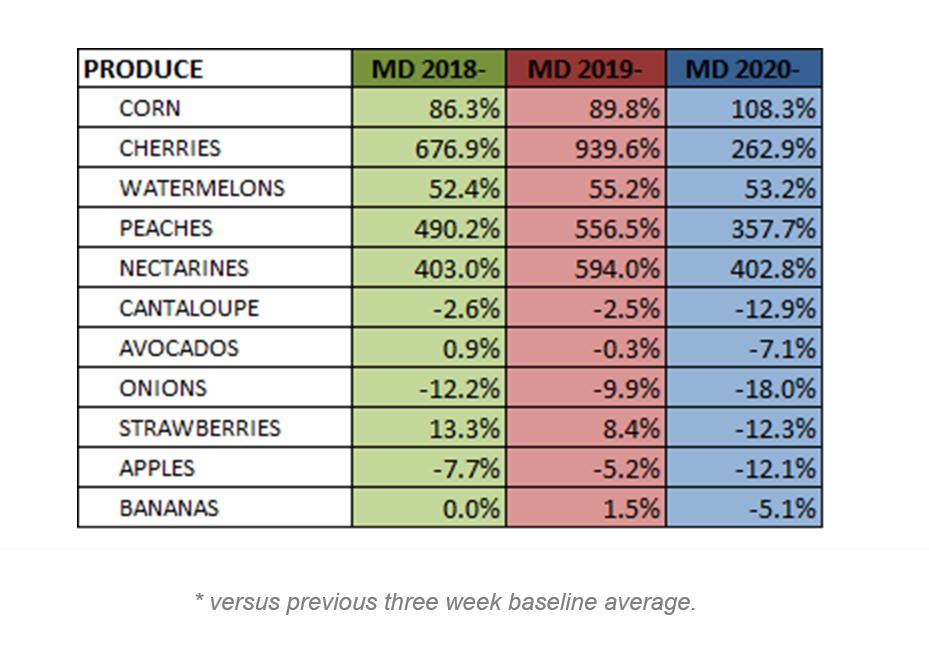

Produce Detail

Categories like Peaches, Nectarines, Avocados, Onions, Strawberries, Cantaloupe and Apples dipped below expectations for the holiday. Of the Memorial Day powerhouses, only Corn bucked the trend by exhibiting a larger holiday week lift relative to previous years.

* versus previous three week baseline average.

REPORT DETAIL

The team at Category Partners has received a growing number of questions related to the patterns and realities of perishables grocery purchases in a post-COVID retail environment. Questions including things like…

• How permanent is the growth of the e-commerce shopping behavior?

• What are consumers prioritizing as they navigate health, safety, convenience, sustainability and their budgets?

• Will category volumes that spiked or declined in 2020 remain inverted or return back to pre-COVID levels and patterns?

Category Partners took a unique approach by isolating a traditional, national event that heavily involves perishables food consumption to observe what the sales data might reveal. The Category Partners team noticed some interesting patterns highlighted in greater detail below.

Naturally the missing link to completing the observations are the sales data for the 2021 holiday next week itself. Once those numbers are available, the Category Partners team believes the industry can observe a particular and predictable point in time and whether or not 2021 Memorial Day sales suggest a return to traditional patterns or if 2020 was the start of potentially new ones.

Source: NielsenIQ, Total U.S., individual weeks of April-May, 2018-2021