Which is more volatile: fresh produce markets or the latest “hustle” cryptocurrency?

Rising or falling 30 percent is just another week in the life of a fresh produce commodity. Elon Musk, aka The Dogefather, couldn’t prevent Dogecoin from freefall after his SNL performance.

Likewise, growers across multiple categories fight to stave off the inevitable price crashes after new growing regions begin in full swing.

After a week at historic highs, the market’s strength screeched to a halt and hightailed it in the opposite direction.

Blue Book has teamed with ProduceIQ BB #:368175 to bring the ProduceIQ Index to its readers. The index provides a produce industry price benchmark using 40 top commodities to provide data for decision making.

ProduceIQ Index: $1.01 /pound, -8.2 percent over prior week

Week #18 ending May 7th

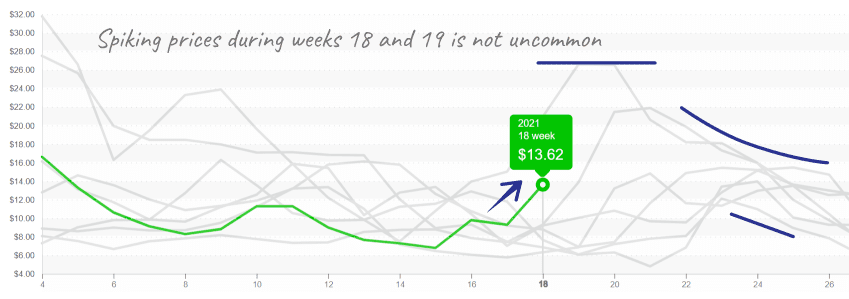

There is no longer a need to subsidize your watermelon cravings with less expensive melons. In a Florida Costco, for about the same price as a carton of blueberries, consumers can have a watermelon heavy enough to substitute a trip to the gym.

One problem remains, although you may feel in better shape after hoisting hefty melons into your shopping cart, pounds are expensive to transport. Finding freight for the dense, juicy fruit proves to be difficult in a logistically challenged market.

At $0.13 per pound, 40,000 pounds of watermelon are likely to cost less than the freight to ship the fruit. If you are lucky enough to score cheap freight, watermelon is highly promotable for summer.

Watermelon pricing reflects domestic spring production with high freight rates.

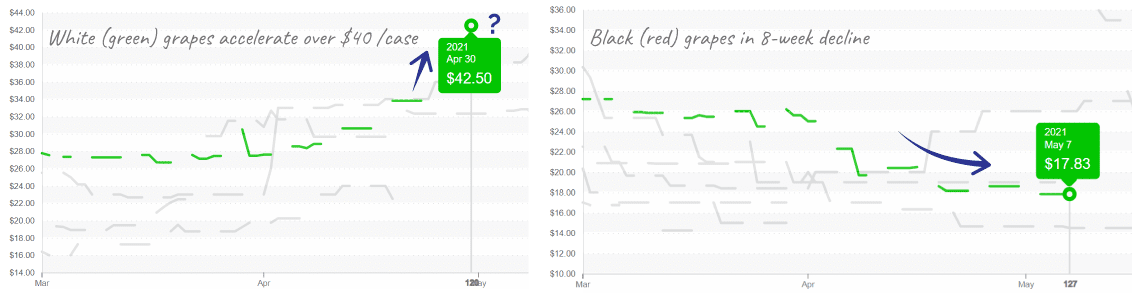

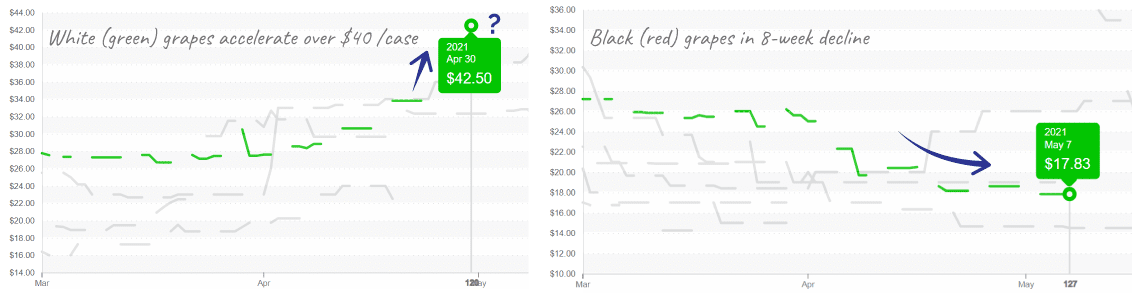

Overall, table grapes fell -24 percent. Grapes differ by variety. While green grape supply is still tight, red grape supply improved significantly. Grapes have struggled to recover from a series of unfortunate events over the past few months.

Rain in Chile, and other acts of God, kept prices elevated but within the bounds of historical precedent. Prices should continue to come down as product from California and Mexico increases quality and availability of both green and red grapes.

Grape market is bifurcated: green rising and red falling.

While the rest of the fresh produce index is singing a song of descent, the orange and tomato markets are determined to stand out.

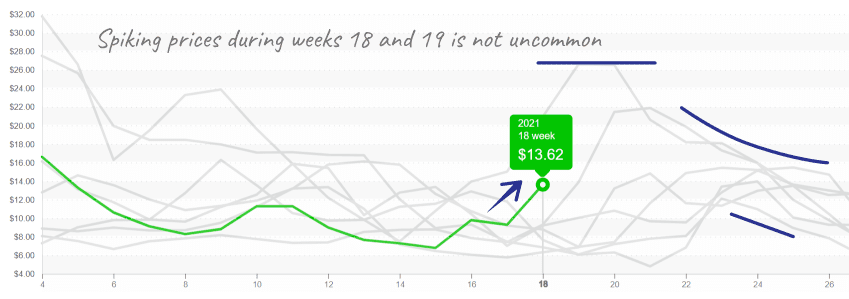

Increases in the price of oranges this time of year are not uncommon. However, exceptionally high demand is pulling up prices unusually fast, up +21 percent over the previous week.

Tomatoes aren’t near the moon, but they did jump off the floor. The category rose a remarkable +34 percent over the previous week. Abnormally warm weather in Eastern growing regions is tightening supply on markets already in a period of transition. Markets are expected to remain on edge for the next month as growing regions move towards Georgia in the East and towards California in the West.

Tomatoes lift off floor prices during northward transition.

Please visit our online marketplace here and enjoy free access to our market tools which created the graphs above.

The ProduceIQ Index is the fresh produce industry’s only shipping point price index. It represents the industry-wide price per pound at the location of packing for domestic produce, and at the port of U.S. entry for imported produce.

ProduceIQ uses 40 top commodities to represent the industry. The Index weights each commodity dynamically, by season, as a function of the weekly 5-year rolling average Sales. Sales are calculated using the USDA’s Agricultural Marketing Service for movement and price data. The Index serves as a fair benchmark for industry price performance.