Prices are exceptionally sensitive this year. With slightly less-than-ideal weather conditions, sellers have been able to double (and triple) prices.

No need for a hard freeze to raise markets recently, when perhaps a cool breeze will due.

Are growers being dramatic and overplaying their supply-is-tight card? Or do produce prices remain below production costs for far too long given a buyer’s actual willingness to pay?

ProduceIQ Index: $1.12 /pound, +3.7 percent over prior week

Week #16, ending April 23rd

Blue Book has teamed with ProduceIQ BB #:368175 to bring the ProduceIQ Index to its readers. The index provides a produce industry price benchmark using 40 top commodities to provide data for decision making.

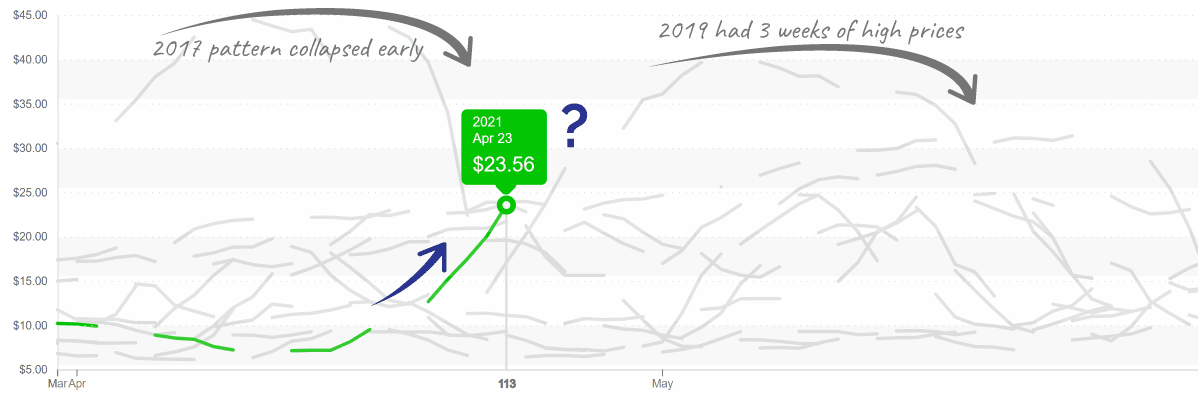

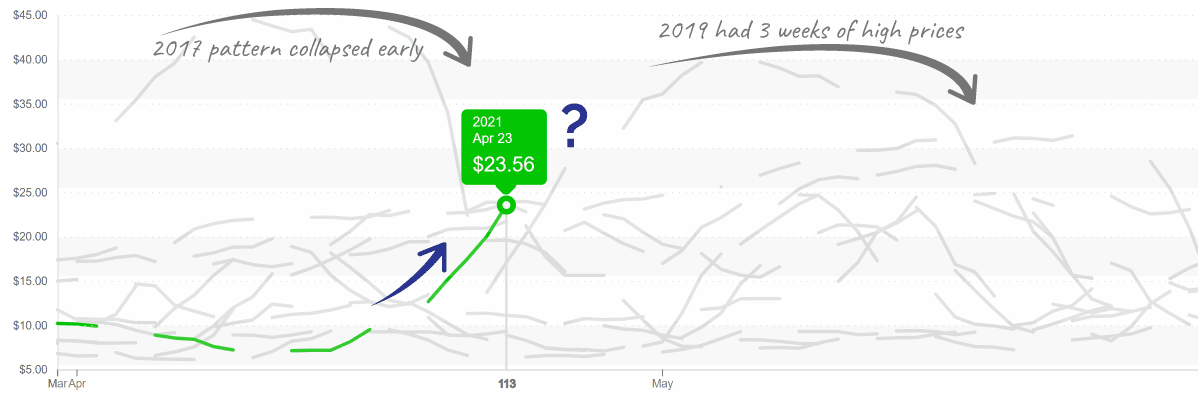

Cooler weather in California is reducing harvest on a variety of commodities, most notably, cauliflower.

ProduceIQ’s cauliflower sub-index jumped +128 percent over the previous week and is expected to rise further. The daily price went from the floor, $7 per case, to $23 per case in less than 10 days. Of course, this rise would be more impressive if the starting price were not far below production costs.

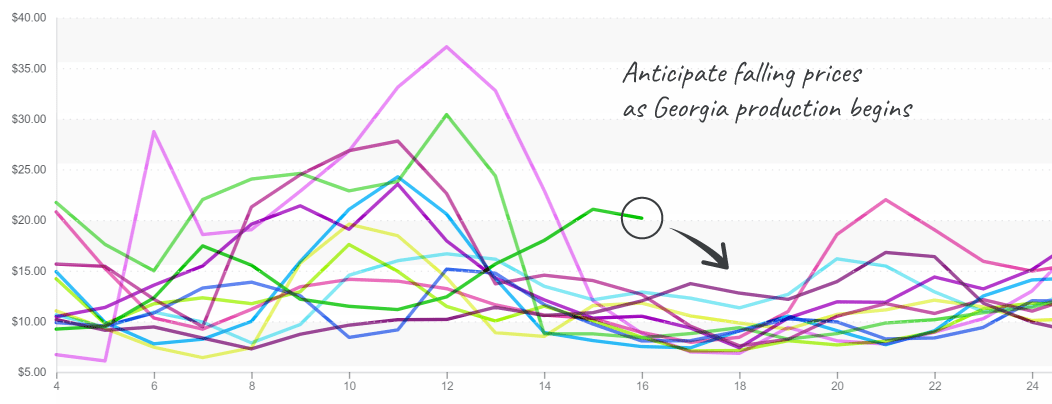

Cauliflower continues the high volatility that has been its norm. Prices spiked last week, mirroring the pattern in 2019.

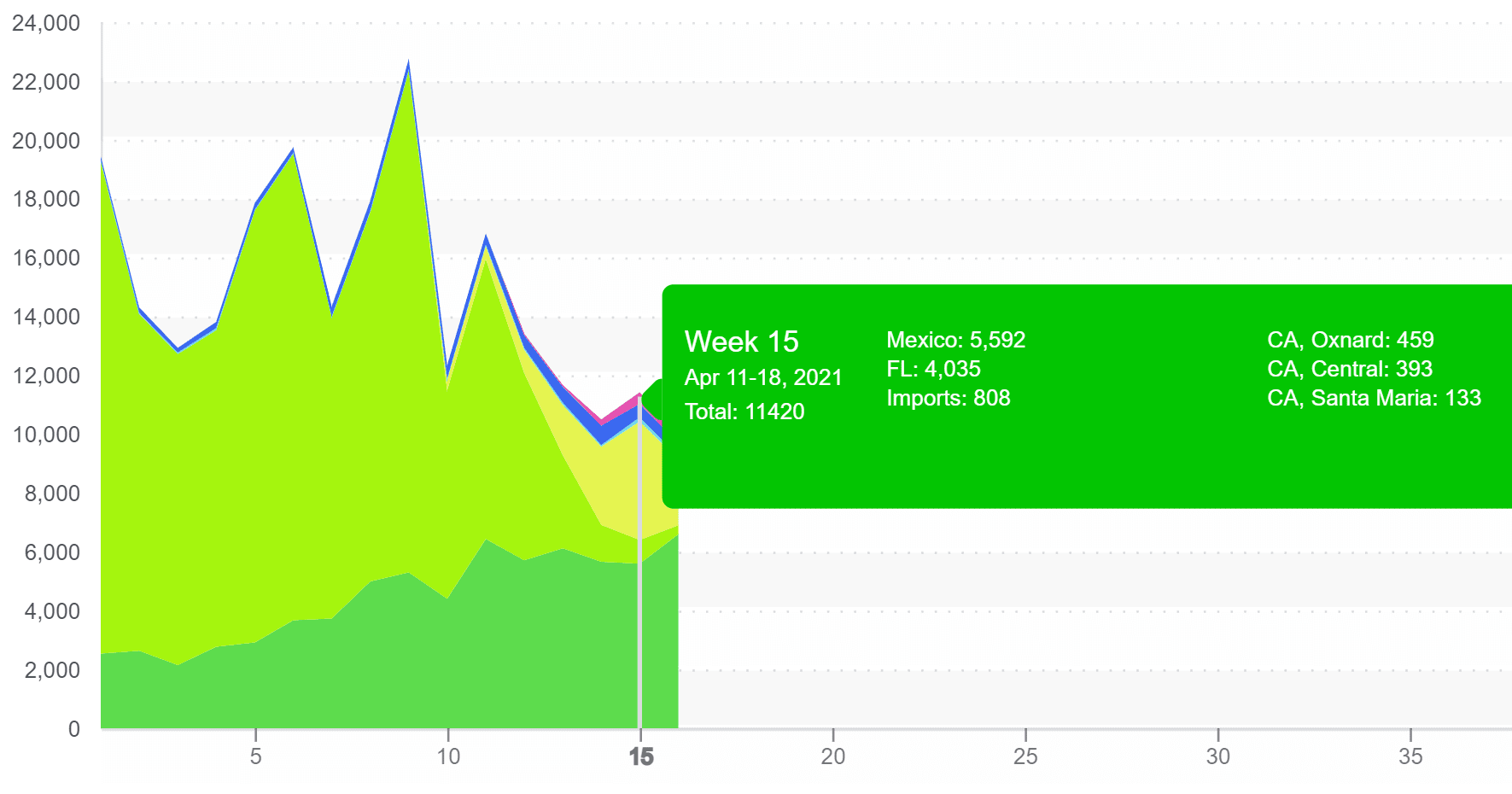

Spurred on by the spring transition, the Dry Vegetable1 category, up 9 percent, is putting on quite the show. Dry Veg production is migrating from Florida to Georgia in the East and from Mexico to California in the West.

Price volatility should be expected throughout the next three weeks as commodities continue their annual migration northward.

[1 Dry vegetable category is also known as truck veg, mixed veg, summer veg, southern veg, and a variety of other names. Which should be the industry standard? We’re listening. ProduceIQ’s dry vegetable category includes pepper, cucumber, squash, beans, cabbage, sweet corn, and asparagus.]

Similar to the sensitivity of the cauliflower price spike, Florida green bean supply is melting under a little pressure from April showers. Supplies grow lighter as Mexico is also struggling to fill orders due to a small gap in production.

Prices jumped from less than $10 per case to over $20 per case in one week. Stay tuned, bean markets move fast with new regions and quick harvests; current circumstances will change rapidly.

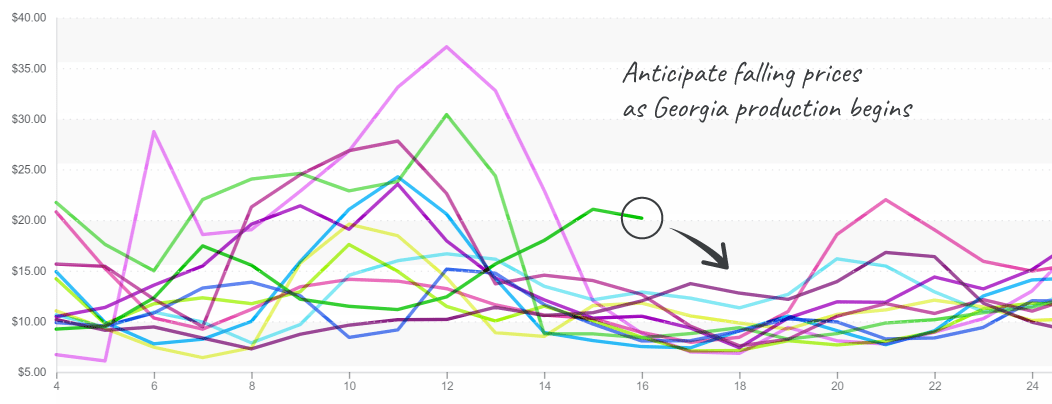

Fledgling production in Northern Mexico is providing relief to a tight cucumber market with high prices. The production gap is closing as both Mexico and Florida are increasing harvests.

Georgia will join its southern counterparts when cucumbers crown in about a week.

Elevated prices in cucumbers’ late season will likely end soon.

Baja California is ramping up on colored peppers while Mexican production of green peppers is winding down. Florida growers are still light on pepper supply and are struggling to generate quality.

Florida sweet corn production is at its peak. For nearly forty years, sweet corn season was celebrated with the annual Zellwood Sweet Corn Festival. The decline of corn grown in the area brought about the end of the festival in 2013, but the sweet memories still live on.

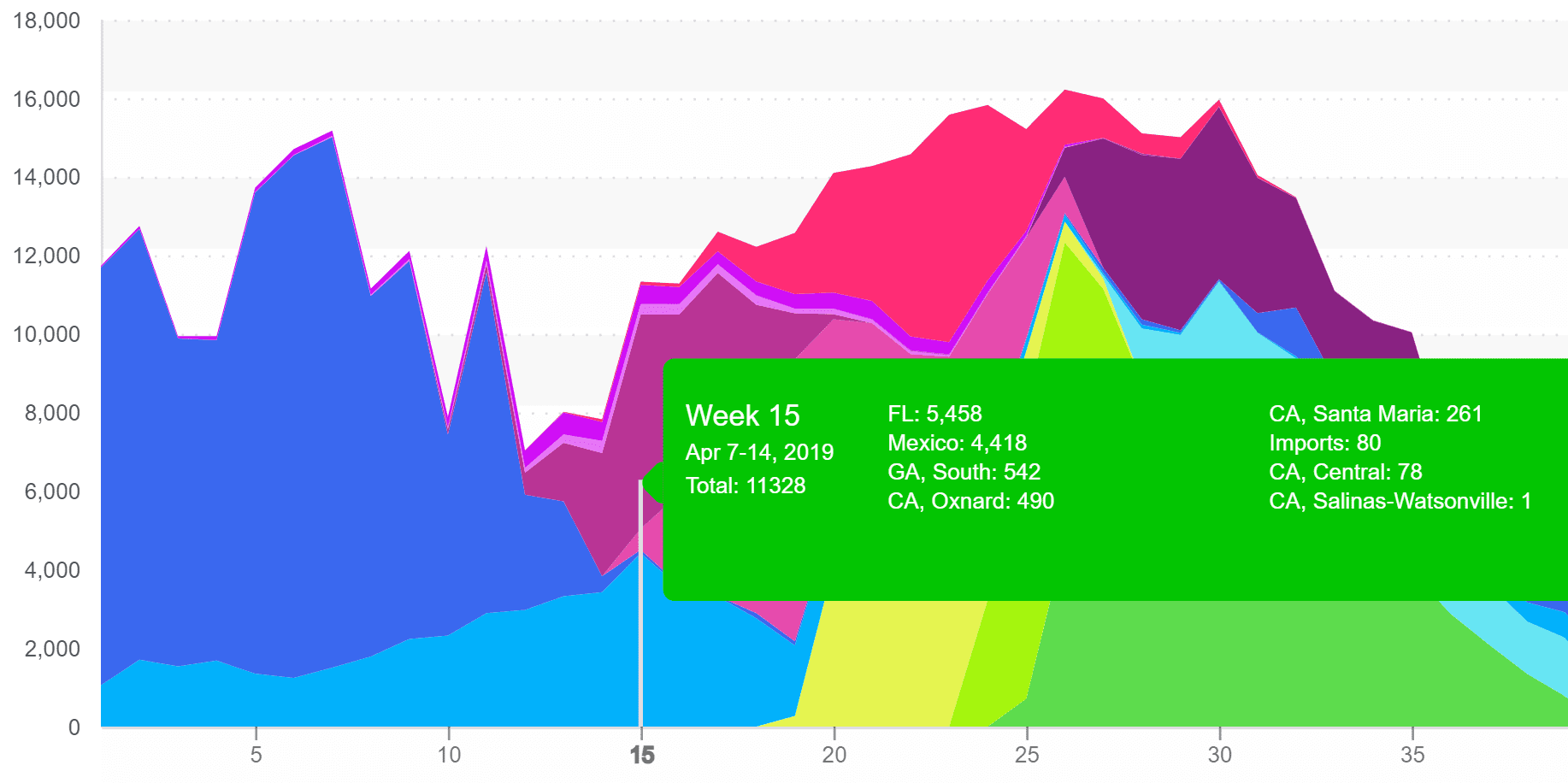

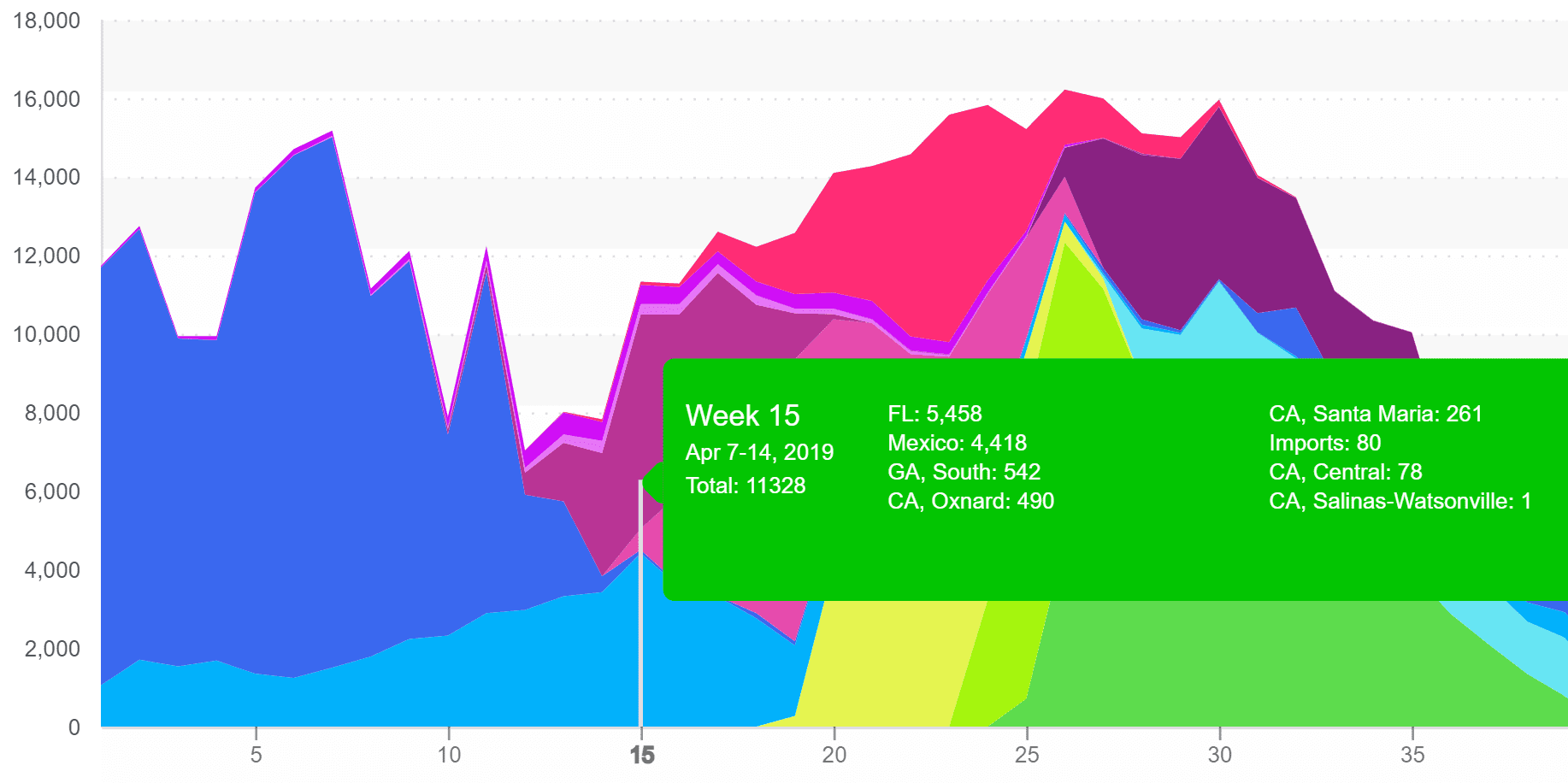

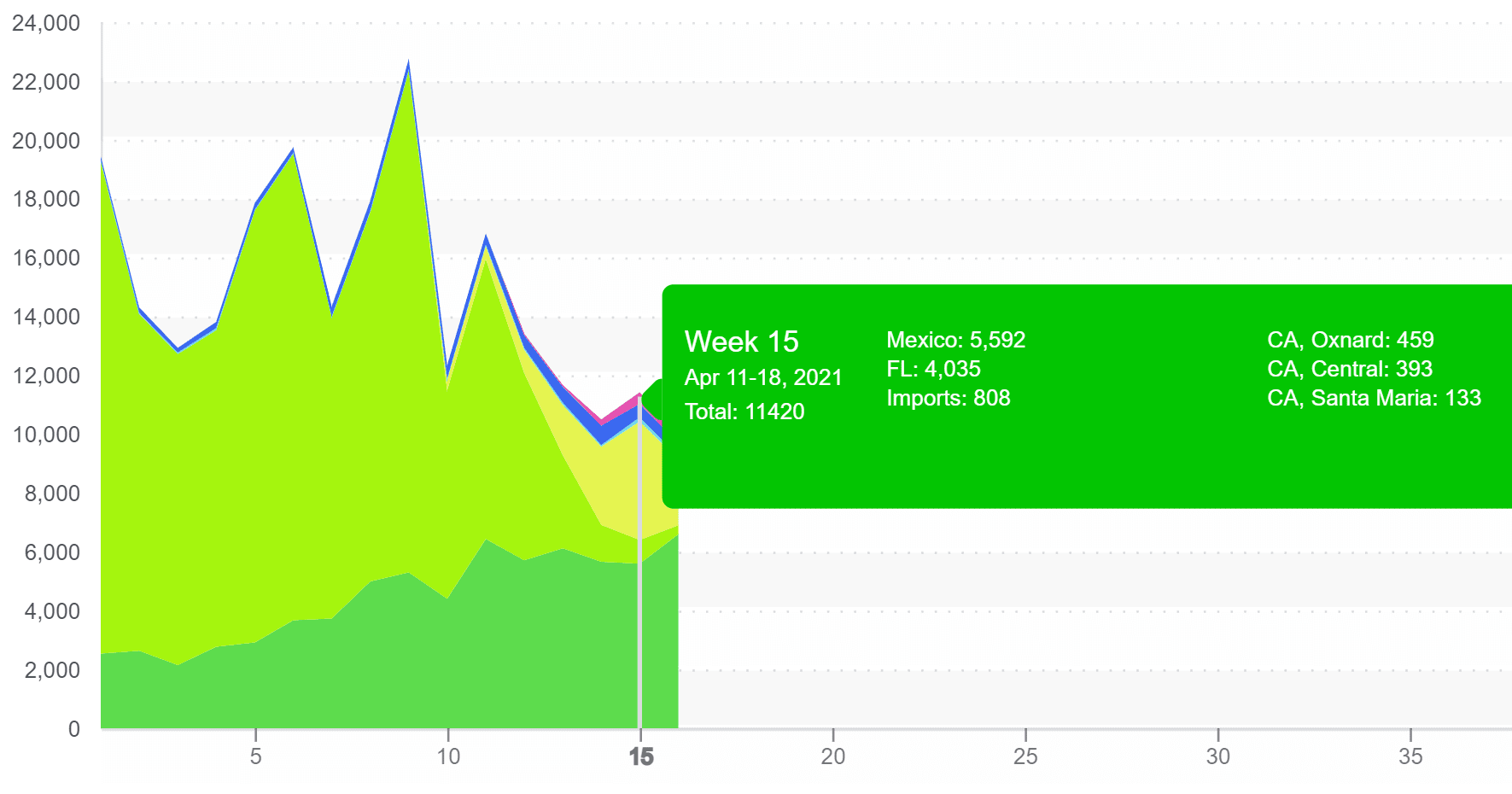

Blueberry prices begin to flatten in the low to mid $30 range. Though Florida is off on yields compared to 2019 and Georgia is late, the overall movement still approximates 11 million pounds for the same week.

Despite the same level of volume in that year, prices had already begun crashing. Prices in 2021, however, remain elevated as other growing regions, such as Georgia, move closer to season.

It seems the “inevitable Spring decline” will have to wait another week or two. Georgia should provide some relief to buyers soon.

2019 versus 2021 movement volume (in thousands of pounds) are essentially the same, yet prices moved in opposite directions.

Although demand is strong, watermelon prices dropped rapidly from over $0.40/pound to under $0.20/pound. South Florida has begun production and Northern Mexico is beginning its watermelon season, increasing supply across markets.

Please visit our online marketplace here and enjoy free access to our market tools which created the graphs above.

The ProduceIQ Index is the fresh produce industry’s only shipping point price index. It represents the industry-wide price per pound at the location of packing for domestic produce, and at the port of U.S. entry for imported produce.

ProduceIQ uses 40 top commodities to represent the industry. The Index weights each commodity dynamically, by season, as a function of the weekly 5-year rolling average Sales. Sales are calculated using the USDA’s Agricultural Marketing Service for movement and price data. The Index serves as a fair benchmark for industry price performance.