Prices are on the upswing, climbing another 7 percent on an industry-wide basis.

Momentum continues to build as temperatures rise and foodservice demand heats up. Corn prices are driving further than any of the golf balls at Viva Fresh.

Viva Fresh in Dallas March 26-27 almost felt like ‘business as usual’. Industry members, mostly growers and shippers, took a breath of fresh air after a year of business unusual. Though several buyers (mostly Texans) attended, corporate policies prevented many produce buyers from air travel to the expo.

Industry representatives were optimistic and energized, nonetheless.

ProduceIQ Index: $1.07 /pound, +7 percent over prior week

(Week #12, ending March 26th)

Blue Book has teamed with ProduceIQ BB #:368175 to bring the ProduceIQ Index to its readers. The index provides a produce industry price benchmark using 40 top commodities to provide data for decision making.

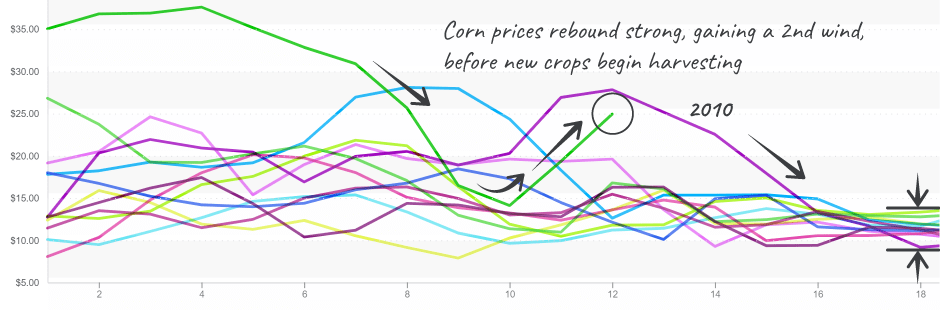

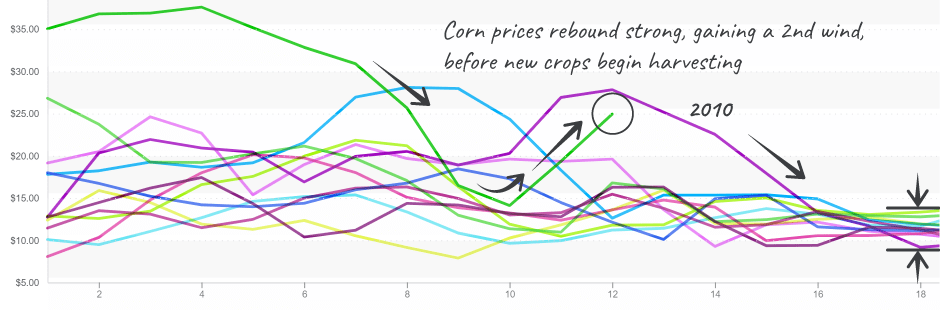

Sweet corn is up 28 percent on low supply, and growers trying to push it to the mid $30s. Corn supplies remain tight, and demand is accelerating as we move into spring.

Yields are down in Florida due to the February freeze (which followed the November rains), but volume from new crops should release pressure on prices as the month of May, peak season for sweet corn in Florida, approaches.

Even in the outlier of 2010, prices had fallen to the $10-15 range by the start of May.

Corn rises to levels not seen since 2010.

The dry-veg category is up 8 percent despite price declines from beans, cabbage and squash. Bell peppers rose 15 percent on varying supply during the crop transition northward in Mexico.

Cucumbers are winding down from Honduras, and spring crop is crowning in Florida. The 11 percent rise is driven by the gap before the Sonora region of Mexico begins production.

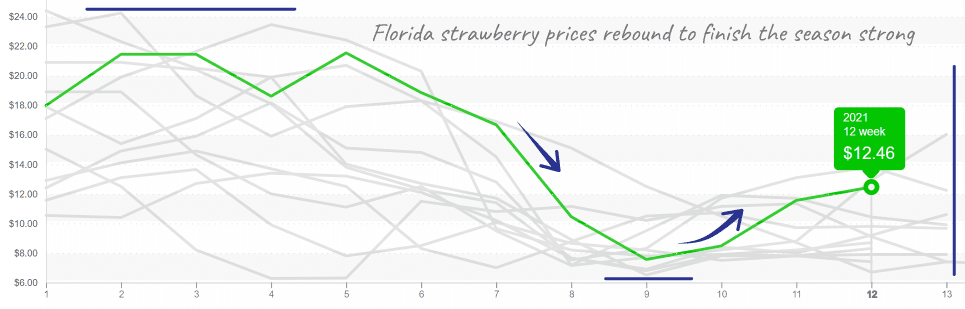

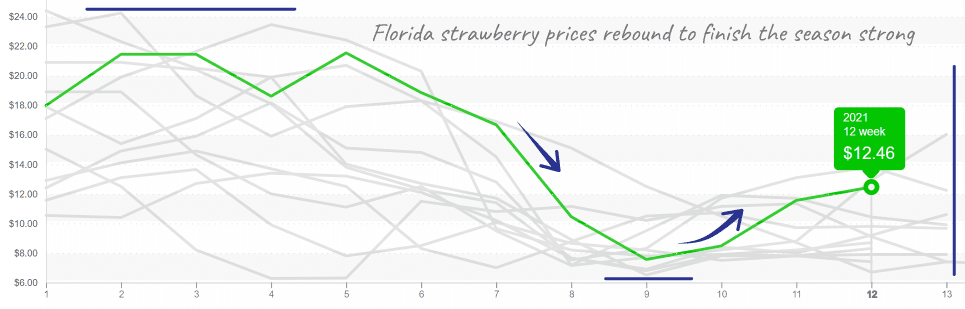

Strawberries rise 16 percent. Poor weather in California, combined with the dwindling of Florida and Mexico’s growing season, is tightening strawberry’s supply and upping prices. Shippers estimate a few weeks before supply and quality recovers.

Strawberries from Florida end their season with higher prices.

Cantaloupe is down another -10 percent to $13/case. Movement is also down, especially in the Western United States, which is dealing with port delays in Southern California.

The U.S. will rely on imports through April until the domestic season for cantaloupes starts in Georgia, Arizona and California.

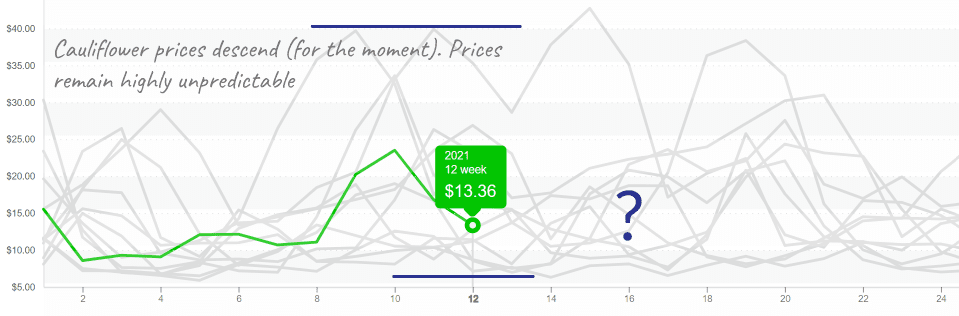

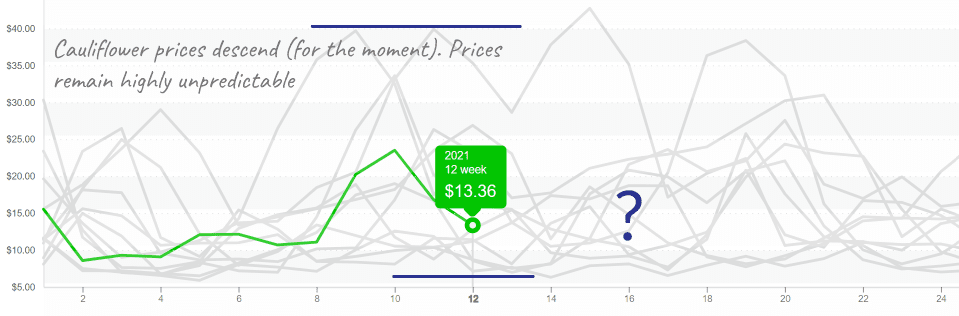

Cauliflower is this week’s biggest loser, falling -22 percent. This level of movement is nothing abnormal for cauliflower, which has tremendous price volatility. Recent cool weather affected quality and volume from Salinas, CA. Movement and quality should improve as cauliflower fully transitions out of Yuma, AZ.

Cauliflower prices fall, yet a rebound is usually near-term.

Please visit our online marketplace here and gain access to our free online tools.

We look forward to hearing from you.

ProduceIQ Index

The ProduceIQ Index is the fresh produce industry’s only shipping point price index. It represents the industry-wide price per pound at the location of packing for domestic produce, and at the port of U.S. entry for imported produce.

produceiq.com

ProduceIQ uses 40 top commodities to represent the industry. The Index weights each commodity dynamically, by season, as a function of the weekly 5-year rolling average Sales. Sales are calculated using the USDA’s Agricultural Marketing Service for movement and price data. The Index serves as a fair benchmark for industry price performance.