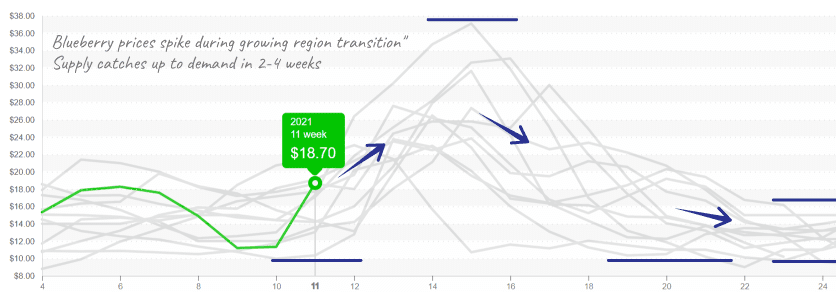

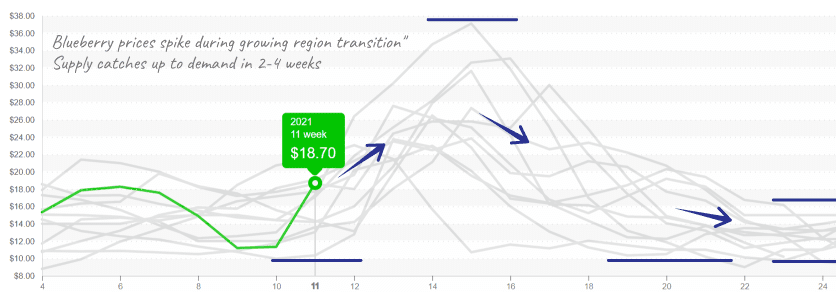

Blueberries are this week’s winner, helping the ProduceIQ Index jump to the highest prices for a week #11.

Overall, markets are rising on increased demand as the weather warms, and foodservice restrictions are loosening. Though core items, such as apples and potatoes, may not be at the highs reached in 2020, prices remain elevated compared to historical norms.

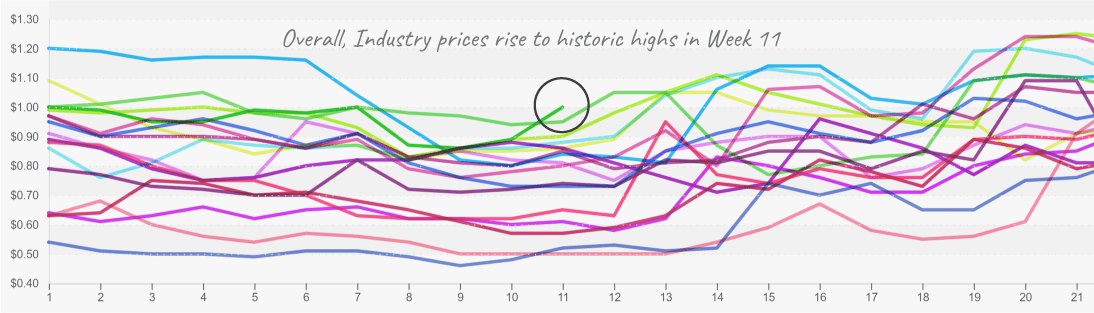

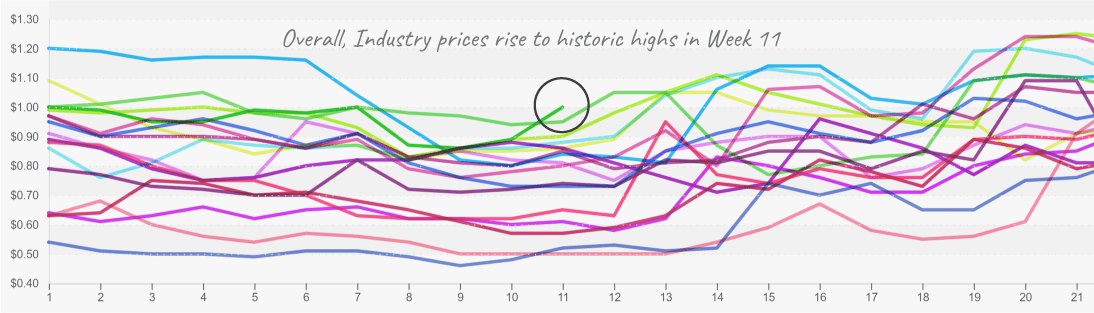

Industry prices surpass 2020 levels, driven by limited supplies and increasing spring demand.

Blue Book has teamed with ProduceIQ BB #:368175 to bring the ProduceIQ Index to its readers. The index provides a produce industry price benchmark using 40 top commodities to provide data for decision making.

ProduceIQ Index: $1.00/pound, +12.4 percent over prior week

Week #11, ending March 19th

Watermelon prices exceed $280/bin, or $19/carton, as demand ticks upward during a supply gap. Offshore volume is winding down, and Mexico doesn’t have much volume until Hermosillo (Northern Mexico) starts in April. Buyers are eagerly awaiting Florida’s start in early April. Demand is high as consumers enjoy the warmer weather.

Blueberry prices rise each year at this time as imported supplies wane and new growing regions increase harvest in 2-4 weeks. The price on a retail pack, 12 6-ounce clamshells, nearly doubled in a week to reach $19.

Strawberries advance after a post-valentine’s lull. Demand increases in anticipation of the Easter pull. Easter is earlier this year, April 4th. Supplies are off as the Florida season is wrapping up and Oxnard, CA assesses the reduced yield from a recent hail event.

Growers try to capitalize on increasing blueberry prices during a transitional time of reduced yield.

Both avocados and limes are benefitting from the increasing foodservice demand. Lime prices finally flattened at high levels, exceeding $45/carton. As the California avocado season is starting, prices remain solid.

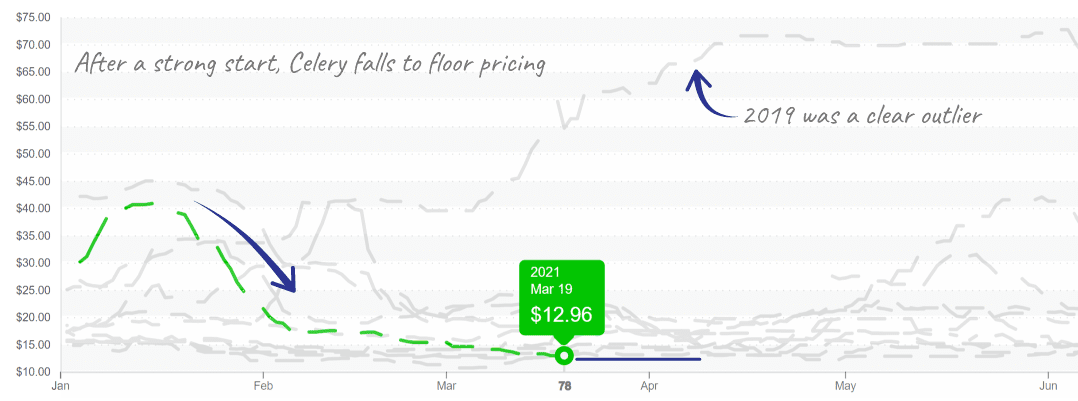

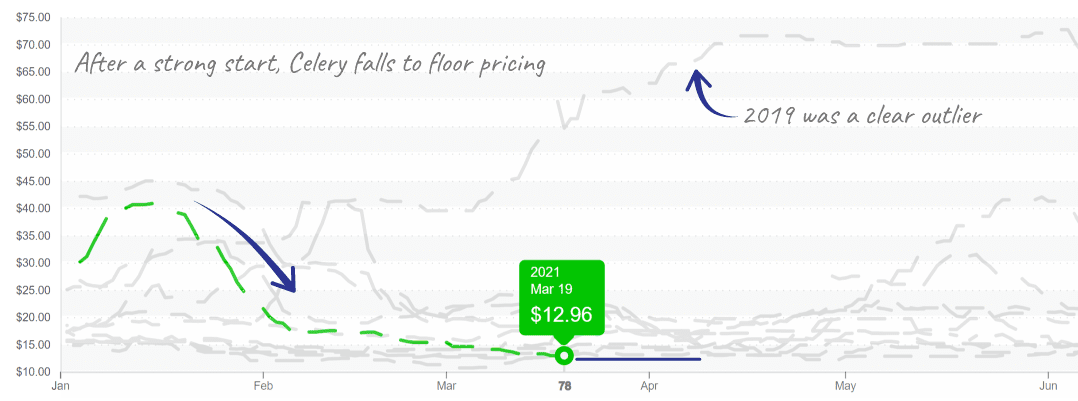

Though dry vegetables had a great week, the wet vegetable category struggled. Celery dropped to floor prices with high levels of quality supplies. Growers realize a sinister truth: some level of supply disruption is needed for attractive pricing.

Bumper yields with beautiful quality often translate to low spot market prices and great buying opportunities.

Perhaps the cool and rainy forecast for some of California will benefit celery? Either way, promotable pricing is available.

Celery growers reminisce the 2019 season as they struggle through floor prices during time of high yields and quality.

Please visit our online marketplace here and gain access to our free online tools.

We look forward to hearing from you.

ProduceIQ Index

The ProduceIQ Index is the fresh produce industry’s only shipping point price index. It represents the industry-wide price per pound at the location of packing for domestic produce, and at the port of U.S. entry for imported produce.

produceiq.com

ProduceIQ uses 40 top commodities to represent the industry. The Index weights each commodity dynamically, by season, as a function of the weekly 5-year rolling average Sales. Sales are calculated using the USDA’s Agricultural Marketing Service for movement and price data. The Index serves as a fair benchmark for industry price performance.