(Week #6, ending February 12th)

ProduceIQ Index: $0.98 /pound, -1.0 percent over prior week

In a pandemic-influenced environment, produce markets are characteristically binary. Winning produce categories tend to have a longer shelf-life and greater retail distribution. Whereas highly perishable produce, and produce dependent on foodservice, are suffering at floor prices, mostly below production costs.

Most fruits, berries, and “hardware” (carrots, table-stock potatoes) are outperforming historic averages. These categories are benefiting from both increased retail volume and the USDA box programs. On the other hand, dry vegetables, wet vegetables and tomatoes are experiencing a tough mid-winter season. The anemic level of foodservice demand is enough to collapse pricing to near post-harvest variable costs. With a few southern exceptions (e.g. Florida and Texas), dining restrictions and bad weather has frozen foodservice demand.

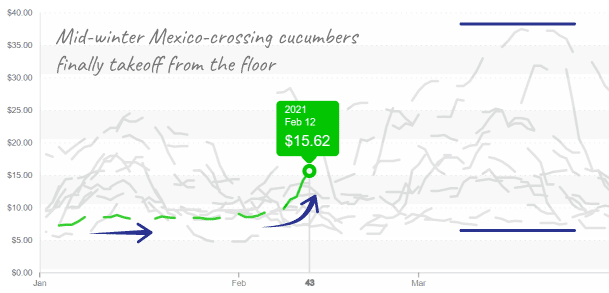

Cucumbers are the exception in the depressed dry vegetable category, down 17%. After wallowing at prices well below production costs, cucumbers finally took off last week from $8.00 to $16.00. Unfortunately, achieving these gains required Mexican growers to slow down harvests, which means cucumbers left unharvested did nothing more than fertilize the soil.

Advocates for reducing food waste may be disappointed by the Mexican cucumbers fate. Certain vegetables, such as cucumbers, squash and beans have relatively low growing costs compared to the post-harvest costs, which makes them vulnerable to discing or skipping harvest. In particular, cucumbers are heavy and have high freight costs. Rather than risk losing more money post-harvest (e.g. by not returning back to the farm the future variable costs), growers may cut the cucumbers off to drop, leaving them in the field, which allows the cucumber plant to continue producing. In this case, the strategy seemed effective in bringing a healthier balance back to the markets.

Cucumbers finally takeoff from floor pricing. Sufficient supply remains to keep market stable.

Green bell peppers have descended to floor prices, driven by good supply in Florida and Mexico.

The ‘wet veg’ category is similarly depressed with low FOB’s, significantly below growing costs. As a self-reported data source, USDA prices seem less indicative of the true market during these very low-priced market events. With price lists in the $8 range, iceberg is at the floor. Unfortunately, romaine and the rest of the category have prices mirroring iceberg. Growers report discing acres under due to low demand, similar to markets in March and April of last year.

Limes increased +45 percent as they enter a transitional supply gap. The current crop has yield and quality issues. Rainy weather combined with high demand will likely push this market higher.

Even after a rise from $10 to the mid $30s, limes have a history of pushing higher during late February to early May.

We seek all feedback.

ProduceIQ Index

The ProduceIQ Index is the fresh produce industry’s only shipping point price index. It represents the industry-wide price per pound at the location of packing for domestic produce, and at the port of U.S. entry for imported produce.

ProduceIQ uses 40 top commodities to represent the industry. The Index weights each commodity dynamically, by season, as a function of the weekly 5-year rolling average Sales. Sales are calculated using the USDA’s Agricultural Marketing Service for movement and price data. The Index serves as a fair benchmark for industry price performance.