One thing is usually consistent in an election year. Whatever party loses, some voters threaten to move to Canada for the next four years. If they actually followed through on the threat, one thing is for sure, they would have plenty of potatoes to keep them well fed.

While Idaho remains the behemoth, Canada has put a stake in the ground when it comes to exporting potatoes into the U.S.

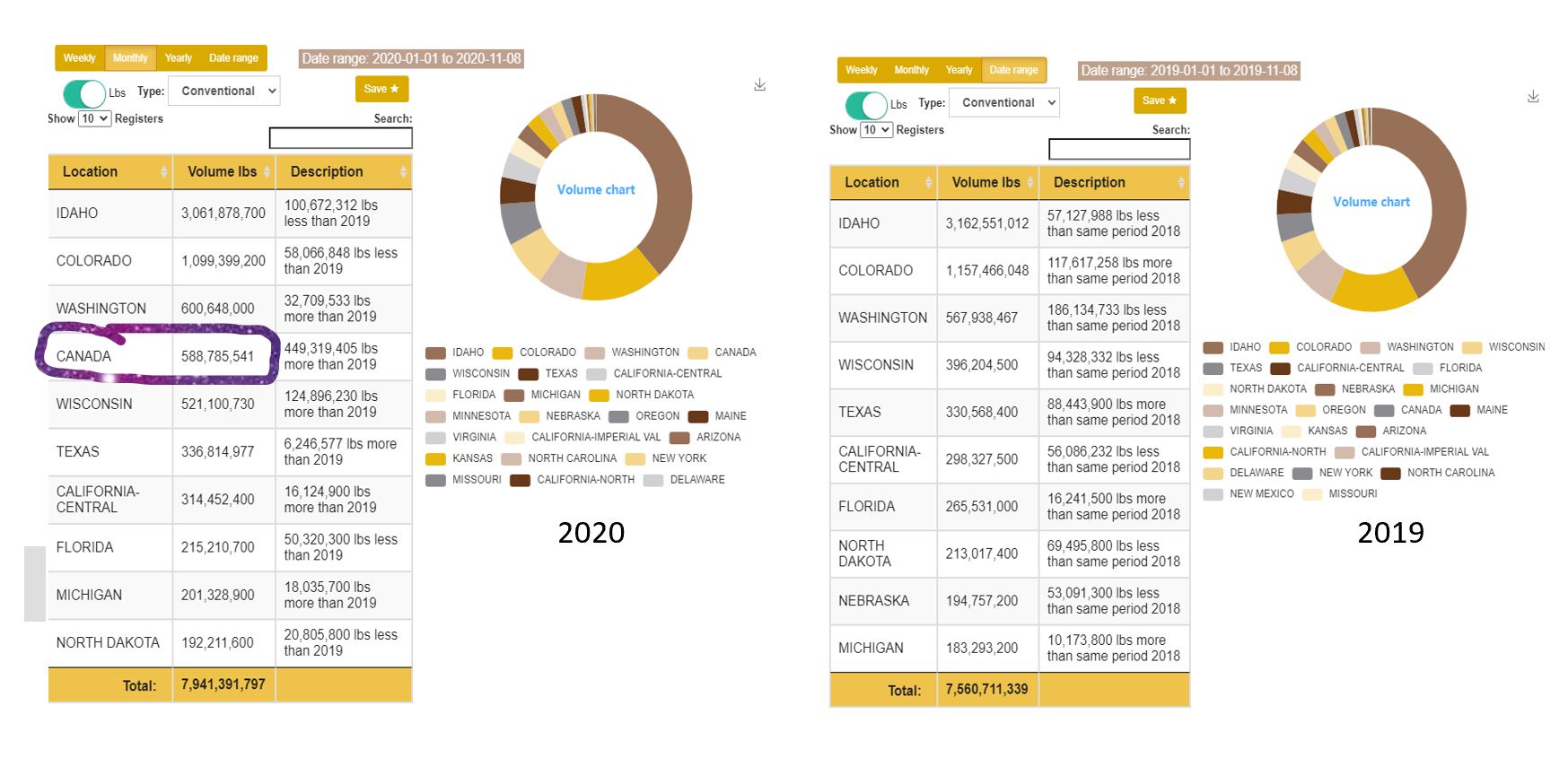

Take a look at the volume comparison below. On the left is 2020 and the right, 2019. Canada didn’t even show up last year on the first page of the leaderboard.

In fact, Canada trailed Minnesota and Oregon in terms of volume. However, look at 2020 and it has surged to the No. 4 spot by bringing in nearly 450 million more pounds of product.

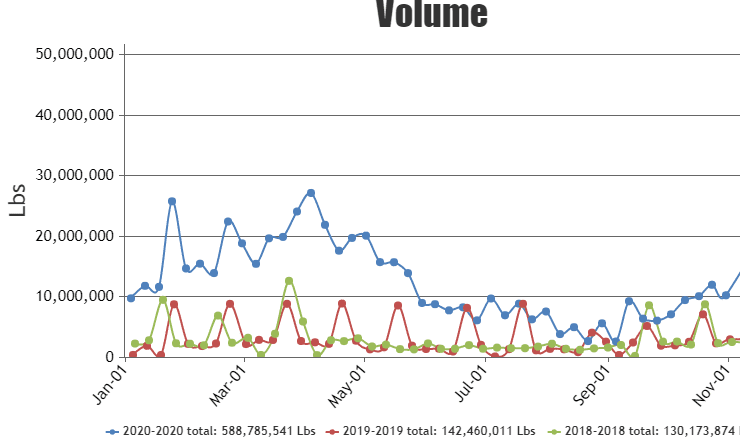

This year has been so successful for Canada, that by looking at the graph below, there are only four times in the last 2 years that 2020 didn’t exceed the weekly volume brought into the U.S.

Blue Book has teamed with Agtools Inc., BB #:355102 the data analytic service for the produce industry, to look how a fruit or vegetable fared in 2020 and what it should expect next year.

Pricing

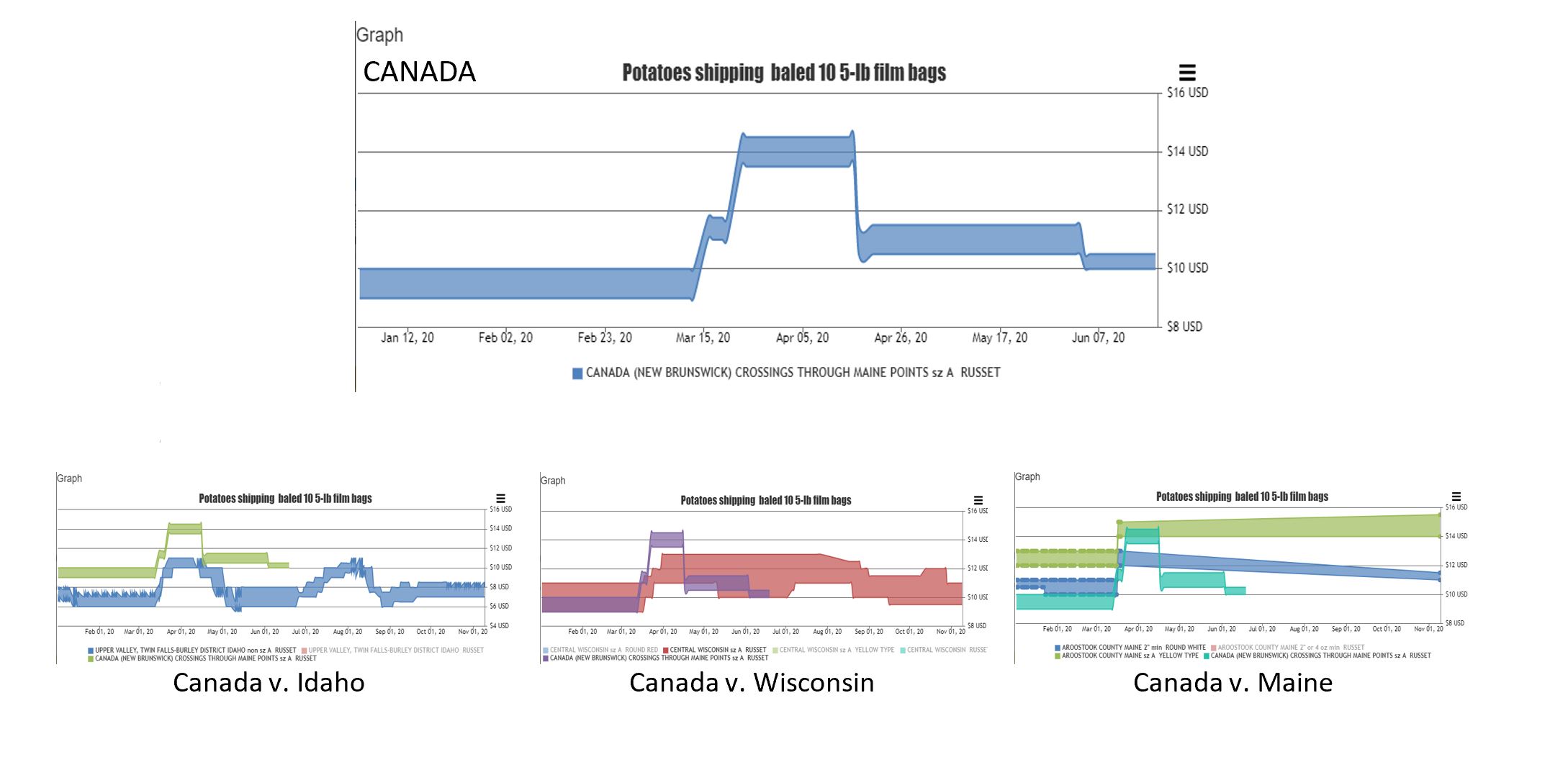

Since volume is up dramatically vs. the previous years, what impact has it had on the pricing? As you will see in the comparison below, the pricing is still the biggest challenge for Canada.

Idaho potatoes are significantly cheaper, but we are talking F.O.B.s and not delivered to the East Coast. When looking at other options closer to the east coast, outside of Maine potatoes, the results are the same.

Sticking to 5-pound russet potatoes, let’s dig into the regional retail pricing. Comparing first the Northeast to the Southeast. The Southeast has more dramatic pricing swings and hovers around the $3.99 retail level more than the Northeast.

Similarly, the Southwest retails, while extremely close to the Northwest, exceeds retail levels on multiple occasions with a $3.99 spike in February. However, the impact of Idaho’s volume is evident in keeping overall retail pricing well below the eastern seaboard.

What’s next?

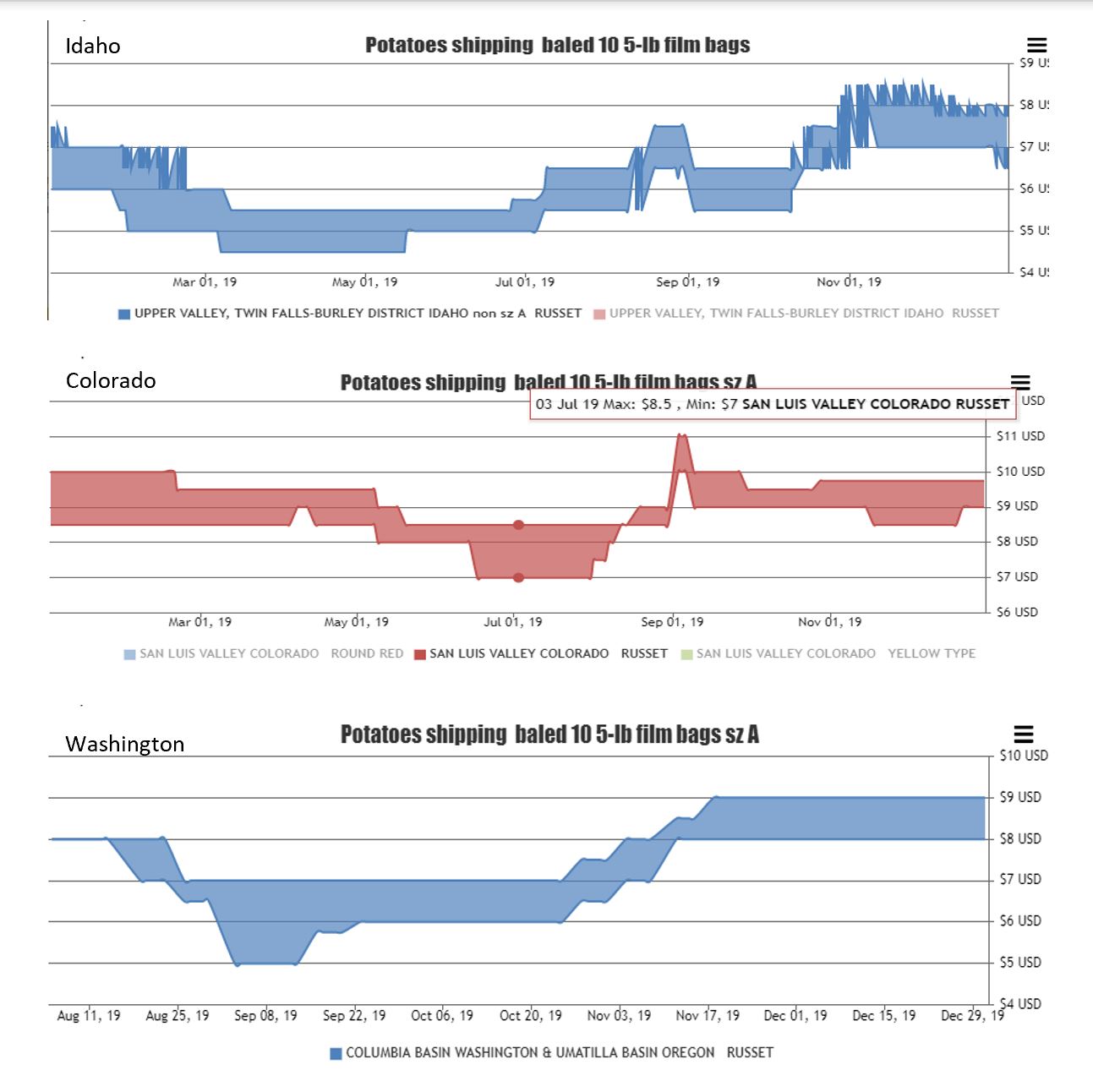

Finally, we look to the past to estimate the future. Looking at the top three growing regions, the last few months showed a rise in shipping F.O.B.s in 2019. While nothing drastic took place, it is something to keep an eye on.

As we have stated in previous articles on potatoes, it is nice to have something in 2020 that is reliable, consistent, and not battered by the elements we have faced this year.

It will be interesting to see if the growth of Canadian imports continues, but regardless, Idaho continues to be the dominant player in the industry.