Pandemic shopping trends have hit grapes harder than many commodities.

Volumes have been down since the start of spring, which has affected the Mexican and Californian crops more than Chile and Peru, which were winding down as the pandemic was winding up in the U.S.

Since the mid-March lockdowns, retail grape sales have slumped, never reaching the sales from the same time last year. In August, sales were about 15 percent lower than the previous year.

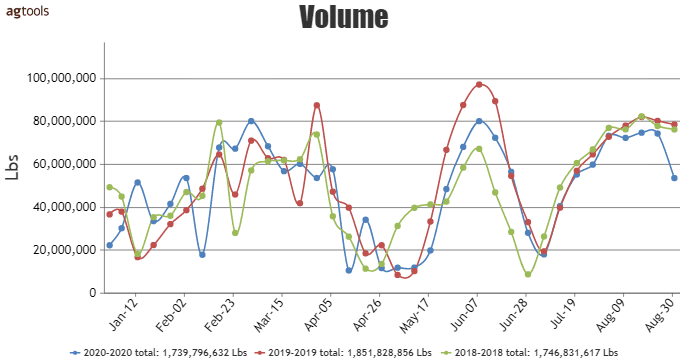

2020 YTD TOTAL VOLUME 3 YEAR COMPARISION

In the first quarter, the volume in 2020 was very similar to 2018 and better than 2019, however after mid-March, the market lost momentum and dropped below 2019 until mid-June, said Raul Lopez, agronomist and vice president of Agtools Inc. BB #:355102

Blue Book has teamed with Agtools Inc., the data analytic service for the produce industry, to look at a handful of crops and how they’re adjusting in the market during the pandemic.

After that, volume has recovered and is performing similar to the previous years.

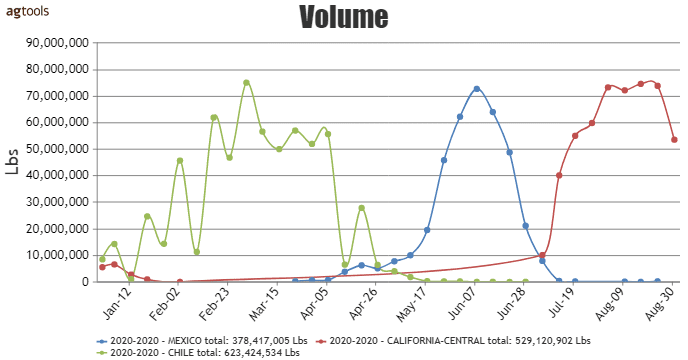

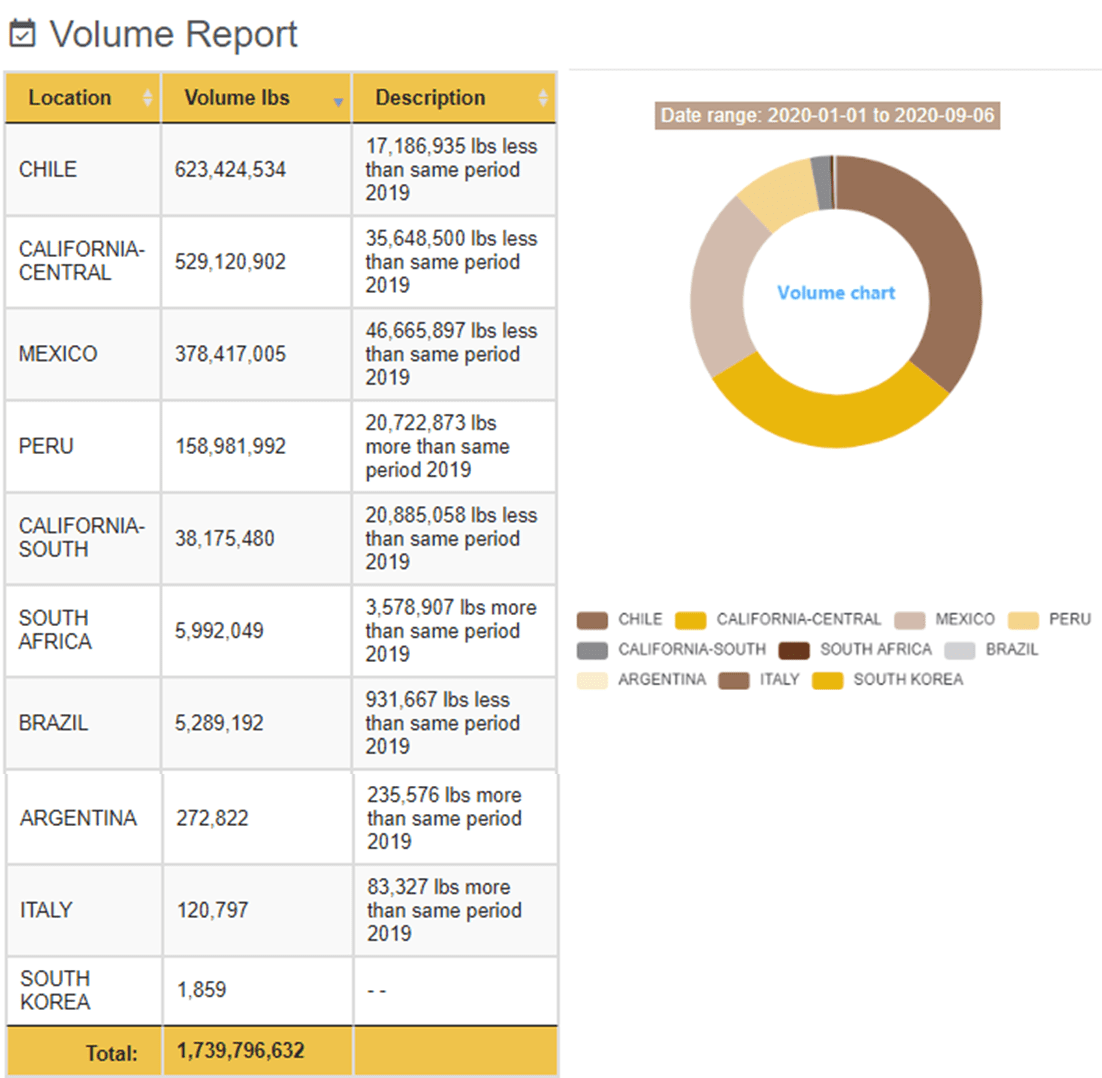

VOLUME BY REGION IN 2020

Chile and Mexico already ended their season, Lopez said. With the California central season on going, the market could recover in the rest of the year. YTD the comparison is 6 percent less than 2019. The pandemic effect is almost over, so the market could react in the next months.

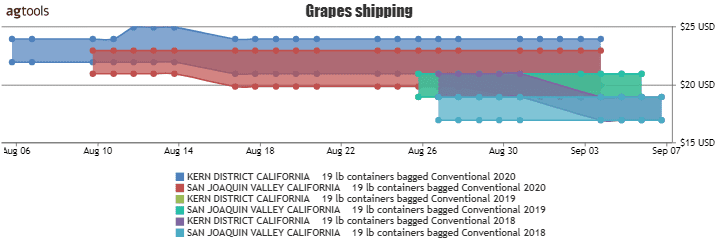

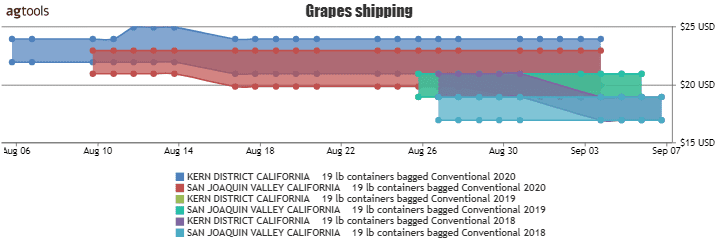

F.O.B. PRICE FOR CONVENTIONAL WHITE SEEDLESS GRAPE FROM CALIFORNIA CENTRAL

The F.O.B. price for the white seedless grapes in California has been very steady, Lopez said. The highest price is equal to that of 2019. The low price started better, however this range is behaving the same as 2019, between $19-23 per case.

F.O.B PRICE FOR RED SEEDLESS GRAPES FROM CALIFORNIA CENTRAL

Red seedless grapes prices are a little stronger than in 2019 and 2018 from both regions, Kern district and San Joaquin Valley, Lopez said Even if the volumes are behind 2019, the price per case could result in a better season for this variety.

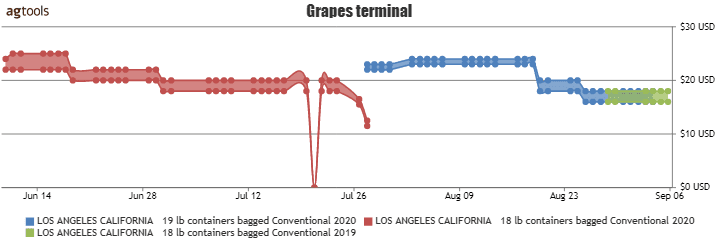

LOS ANGELES TERMINAL MARKET PRICE FOR CONVENTIONAL

The price in Los Angeles terminal market for white seedless grapes also began higher this year than 2019, Lopez said.

However, in September, the price came down to match the ones in 2019. He said it seems like there will be a steady market for the next few weeks.

GRAPE MARKET STATUS

2020 has been a tough year for the grape market, Lopez said. YTD volume vs 2019 has dropped 6 percent. California central and Mexico are the most affected regions. Mainly because of the lockdown during the season. Chile and Peru were not affected that much because they ended season before the crisis.

MARKET SHARE PER REGION

Chile holds more than 35 percent of the market share YTD and its volume dropped 2.6 percent compared to 2019. California central holds 30 percent. This region has reduced its volume by 6 percent vs 2019, however the season is still running, and will increase the market share and maybe improve this year volume as the year goes on.

Mexico already ended its season and holds 21 percent. With almost 11 percent less than 2019, is one of the most affected regions this year, same as California south with a loss of 35 percent of volume vs 2019.