Consumer demand has kept mushroom prices higher than usual, even with more than double the volume in the market this summer.

Americans have made up for missing mushrooms in restaurants by buying them at retail at unprecedented levels.

“Mushrooms have been a pandemic powerhouse in retail, with top 10 appearances every single week,” said Joe Watson, VP of Membership and Engagement for the Produce Marketing Association, in the weekly retail sales analysis from 210 Analytics.

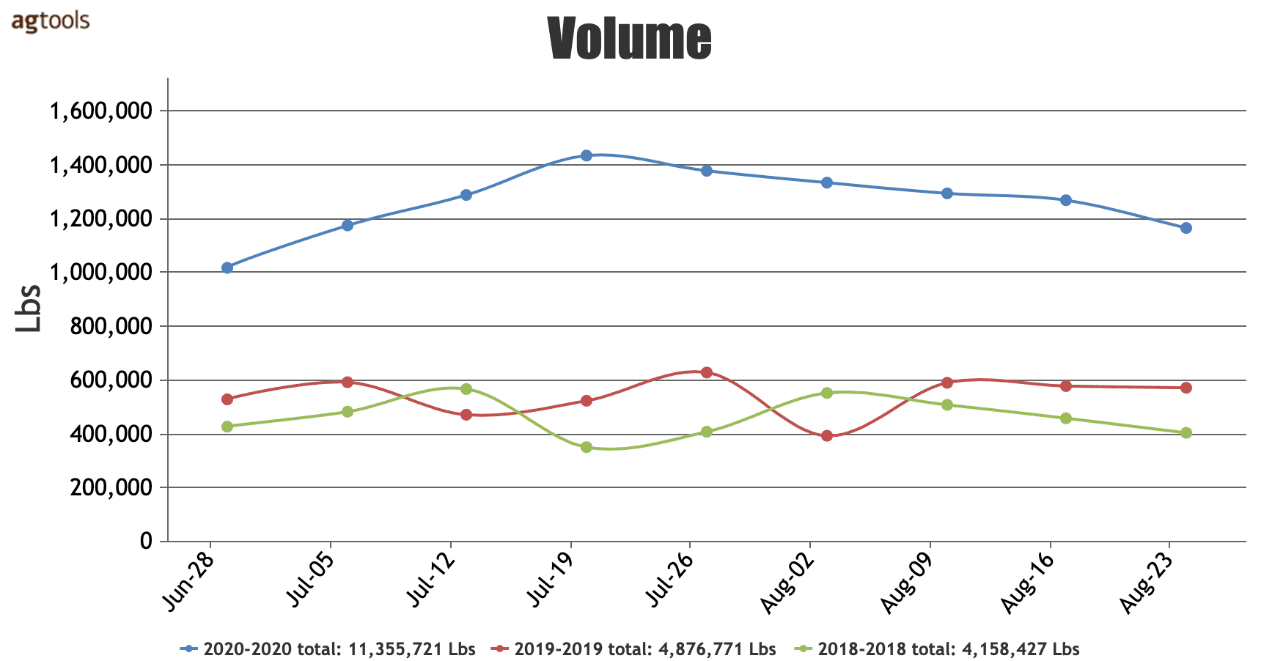

VOLUME TOTAL, MUSHROOMS CONVENTIONAL FROM JULY 1ST THROUGH AUGUST 30TH

A comparison of 2020 volume with 2019 and 2018, for the period between July and August 30, 2020, shows increases of 133 percent and 173 percent respectively, said Paola Ochoa, Program Manager for Agtools Inc. BB #:355102

Blue Book has teamed with Agtools Inc., the data analytic service for the produce industry, to look at a handful of crops and how they’re adjusting in the market during the pandemic.

Demand for this commodity is steadily increasing as evidenced by consecutive years of significant growth.

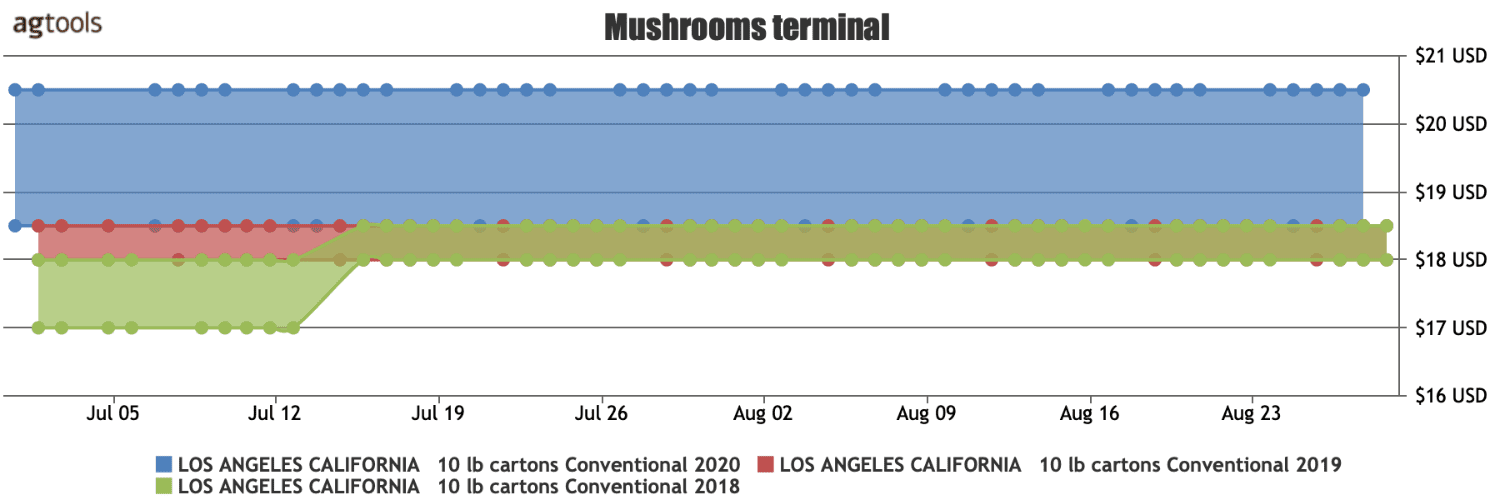

LOS ANGELES TERMINAL PRICE FOR CONVENTIONAL WHITE MUSHROOMS FROM JULY 1ST THROUGH AUGUST 28TH

Just like volume has increased for mushrooms, so have prices, Ochoa said. In 2020 California’s Los Angeles market, prices have been much higher than in previous years.

For instance, the minimum price during the analyzed period equals the maximum price reached during 2019. Also, pricing has been very stable, remaining level for extended periods.

SAN FRANCISCO TERMINAL PRICE FOR CONVENTIONAL WHITE MUSHROOMS FROM CALIFORNIA VS. CANADA, FROM AUGUST 1ST THROUGH AUGUST 31ST

Analysis of the San Francisco market during the last 30 days highlights the usually higher prices associated with domestic products when compared to imports, a repeating pattern seen in other commodities, Ochoa said.

In the case of mushrooms, California’s price is $3 higher than product imported from Canada.

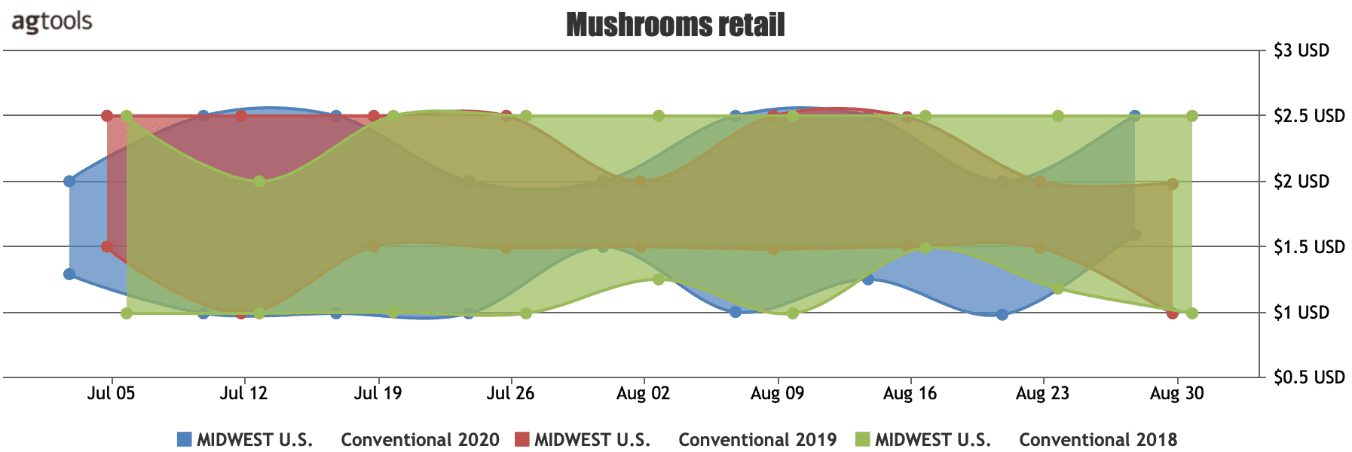

MIDWEST RETAIL PRICE FOR CONVENTIONAL WHITE MUSHROOMS, FROM JULY 1ST THROUGH AUGUST 30TH

The retail price in the Midwest does reflect more volatility, unlike the terminal market price which is very stable, she said.

Despite the associated volatility, the range is stable, usually between $1 and $2.50 during the last three years for the analyzed period.

We can conclude that this product is increasing in volume as well as in price, likely a result of greater consumption across the country, Ochoa said.