ORLANDO, FL, April 7, 2020 /PRNewswire/ — Darden Restaurants, Inc. BB #:111525 today announced additional information given the dynamic environment resulting from COVID-19 and announced the details of a new term loan agreement.

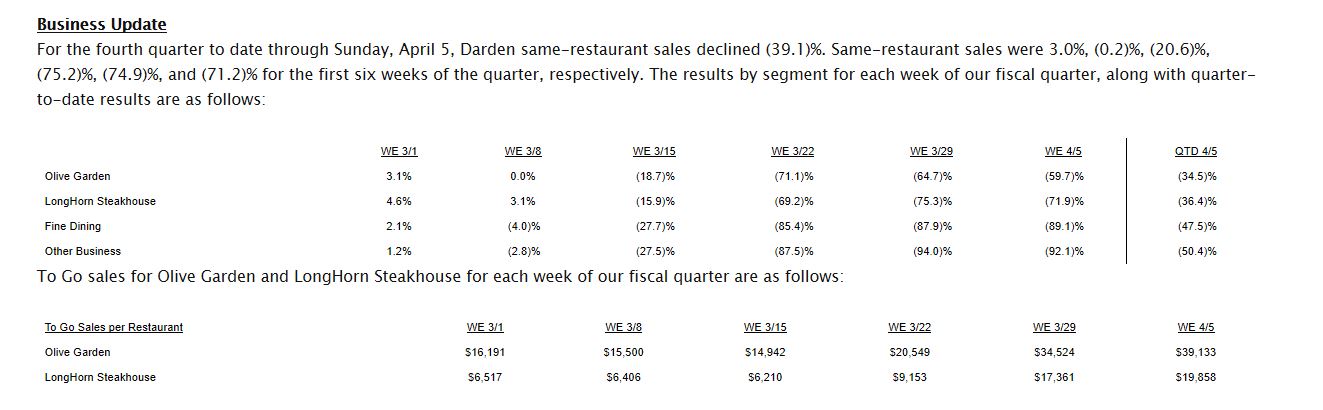

As a result, we are providing an intra-quarter business update to provide quarter-to-date sales trends and other updates on cash utilization and liquidity.

Statement from Gene Lee, CEO:

The health and safety of our guests and team members has always been our first priority, and we continue taking measures to keep our restaurants safe. That is why we introduced a permanent Paid Sick Leave program early last month, closed our dining rooms on March 20th and began to operate our restaurants in a To Go-only capacity. To support our hourly restaurant team members who have not been scheduled while our dining rooms are closed, we rolled out a three-week Emergency Pay Program. Meanwhile, our hourly restaurant team members who are still working will receive an additional payment to help cover unexpected costs, such as transportation and child care, incurred as a result of the current situation.

We are also focused on ensuring we adapt quickly to successfully navigate this situation. Our restaurant teams across all our brands enhanced their To Go offerings, which has enabled Olive Garden to double their already strong off-premise sales and LongHorn Steakhouse to triple their To Go sales. More than ninety-nine percent of our restaurants remain open, with the remaining restaurants temporarily closed due to limited demand or other operational constraints. We will continue to evaluate potential closures on an ongoing basis.

At the same time, we are preserving cash. We have significantly reduced expenses, including marketing, and deferred nearly all of our capital spending, which includes opening new restaurants. Additionally, we are making adjustments at the Restaurant Support Center to match our current operating model. This morning we announced that we will be furloughing some of our team members at the support center and reducing pay for the remaining team members. Senior executives are taking a 50 percent reduction as I continue to forego my salary until we are successfully on the other side of this. Finally, we have taken a new term loan to provide further liquidity.

I want to express my gratitude for the 190,000 team members who make up the Darden family. To those serving our guests every day: I am incredibly proud of how hard you are working to support our communities during a time when the comfort of a warm meal is more vital than ever. And to our furloughed team members: hang in there. We will get through this. And when our dining rooms reopen, we will be together as a family once again, ready to deliver exceptional experiences to our loyal guests.

The challenges of this unprecedented situation are far from over. However, I remain confident that the strength of our portfolio, the power of our competitive advantages and the resiliency of our people will enable us to successfully navigate our way through it.”

Term Loan

Given continued economic uncertainty arising from COVID-19, the Company announced today that it has entered into a $270 million term loan credit agreement to maximize financial flexibility and further bolster liquidity as a precautionary measure. The term loan was fully drawn on April 6, 2020 and matures on April 5, 2021, and carries a current interest rate of LIBOR + 300 basis points. The agreement also includes a provision allowing the Company to request an increase of up to $100 million in borrowings at the election of existing or new lenders.

Bank of America, N.A., served as administrative agent for the new term loan credit agreement. Additionally, BofA Securities, Inc. and U.S. Bank National Association served as joint lead arrangers and joint bookrunners, U.S. Bank National Association served as syndication agent and Truist Bank served as documentation agent.

Cash Utilization and Liquidity Update

Based on the performance through Sunday, April 5, the Company has not used any of the cash proceeds from the previously drawn $750 million revolving credit agreement. With the additional funds from the term loan, the Company now has over $1 billion in investible cash on hand. At recent weekly sales levels, since transitioning operations to a To Go-only format, our ongoing weekly cash burn rate would be approximately $25MM including capital expenditures and not including any additional changes to net working capital.

About Darden

Darden is a restaurant company featuring a portfolio of differentiated brands that include Olive Garden, LongHorn Steakhouse, Cheddar’s Scratch Kitchen, Yard House, The Capital Grille, Seasons 52, Bahama Breeze and Eddie V’s. For more information, please visit www.darden.com.