Imports are king at the Rio Grande Valley border crossings, and the Pharr-Reynosa bridge owes much of its success and status to one fruit: the elegant avocado.

Avocado consumption has spiked in recent years, with Americans nearly doubling their intake in the last decade, from 28 million pounds consumed each week in 2010 to over 50 million a week in 2019.

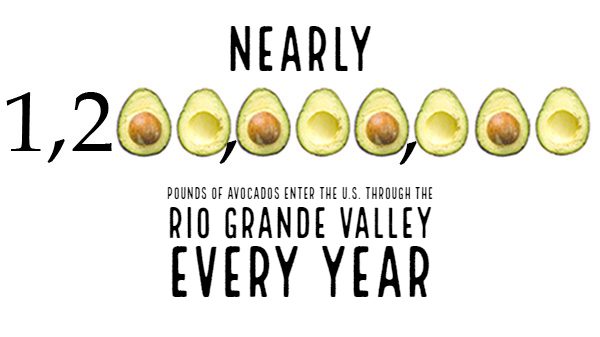

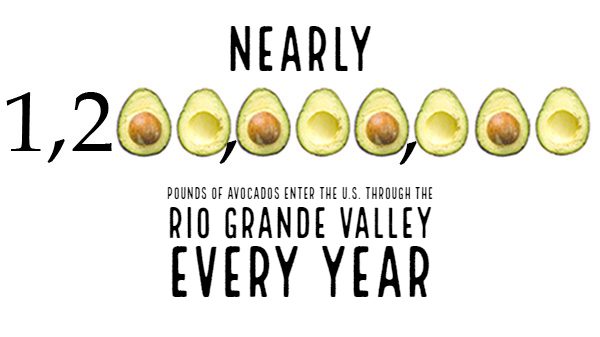

Over 80 percent of these avocados—over 2 billion pounds a year—come from our southerly neighbor Mexico, and over 60 percent of those come in through Pharr.

“Avocados have definitely been the biggest factor in our import growth over the last few years,” said Robert Diaz, director of operations at Fresh Imports International, LLC in Hidalgo. “Changing tastes in the United States have led to a huge demand for them on our end.”

Mexico is also the world’s third-largest producer of fresh raspberries, blackberries, blueberries, and strawberries, and the RGV area has recently overtaken Nogales as the primary port of entry for these fruits as well.

Tomatoes—another longtime powerhouse product that has been driving business at the border for both Nogales and McAllen—remain a staple for retailers across North America and have seen a 20 percent rise in shipments coming into Texas.

Even the festive pineapple—for so long associated with Hawaii and almost always out of reach—is increasing its profile through the Hidalgo ports, with a special facility being constructed on the American side just to house this tropical import.

Exports are few and far between in the perishables trade, as the United States has long been a net importer of fresh produce from Mexico. Although Texas is increasing its share of foreign exports every year—particularly to Mexico—where it’s been creeping up on its nearest rival in California, most of what it sends out are manufactured items, grains, dairy, and meat.

Recent changes in trade status have worked in the Lone Star State’s favor, one example is the manufacturing of electronics and computer components, which has shifted from California to Mexico and led to a weakening of the Golden State’s export strength. Fortunately, Texas has been picking up the slack, along with other manufactured goods and agricultural products.

As a result, despite frequent complaints of holdups at border crossings, traffic is always lighter going out than coming in, with a smaller percentage of trucks bearing a full load as compared to the full shipments of produce in the other direction.

There are, however, still a number of fresh fruits and vegetables moving through the ports in the opposite direction to Mexico, most notably table grapes, apples, and pears, helping augment Texas’ status as accounting for 37.5 percent of total U.S. exports to Mexico.

Another facet of exporting to Mexico from the United States revolves around processed fruits and vegetables for foodservice and specialty stores or businesses. As consumers on both side of the border demand more convenience, value-added products are on the rise.

This is an excerpt from the most recent Produce Blueprints quarterly journal. Click here to read the full supplement.